Management Discussion and Analysis

Financial Capital

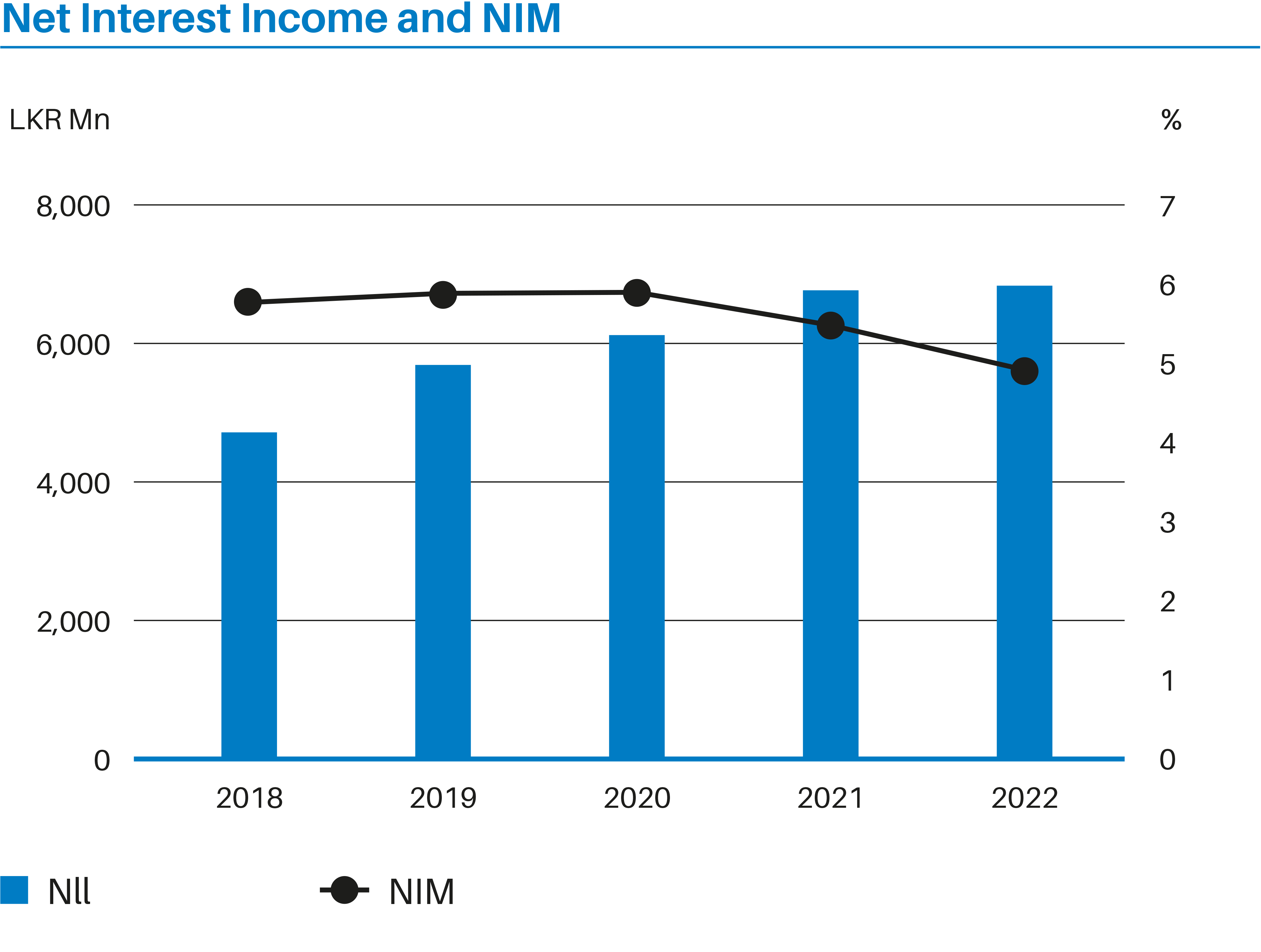

Analysis of the Statement of Profit and Loss Net Interest Income

The net interest income of the bank marginally increased from Rs. 6.774 Bn (2021) to Rs. 6.839 Bn (2022). The Bank was conscious of the importance of maintaining the resilience of its customers and their ability to rebuild after the economic crisis when repricing the loan portfolio. The re-pricing was managed diligently keeping in mind the increased cost of deposits in line with the steep increase in market rates.

Interest expenses which accounted for 54.05% of the interest income in 2021 increased to 70.13% in 2022 due to the highinterest rate regime during this period.

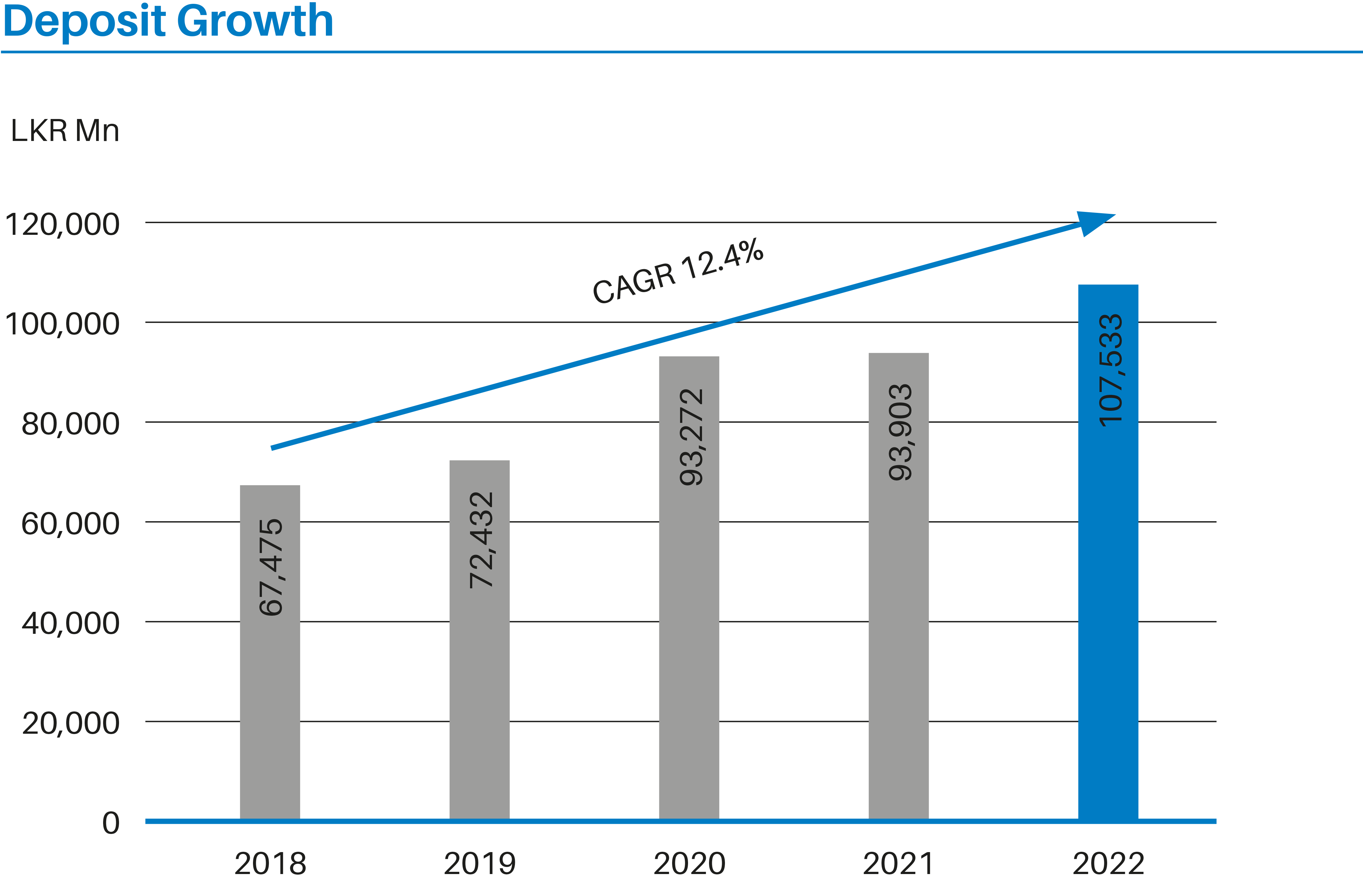

During the year bank’s total deposit base surpassed the Rs.100 Bn mark and stood at Rs.107.5 Bn as at 31-12-2022 which consist of Rs. 93 Bn Fixed deposits and Rs. 14.5 Bn savings deposits.

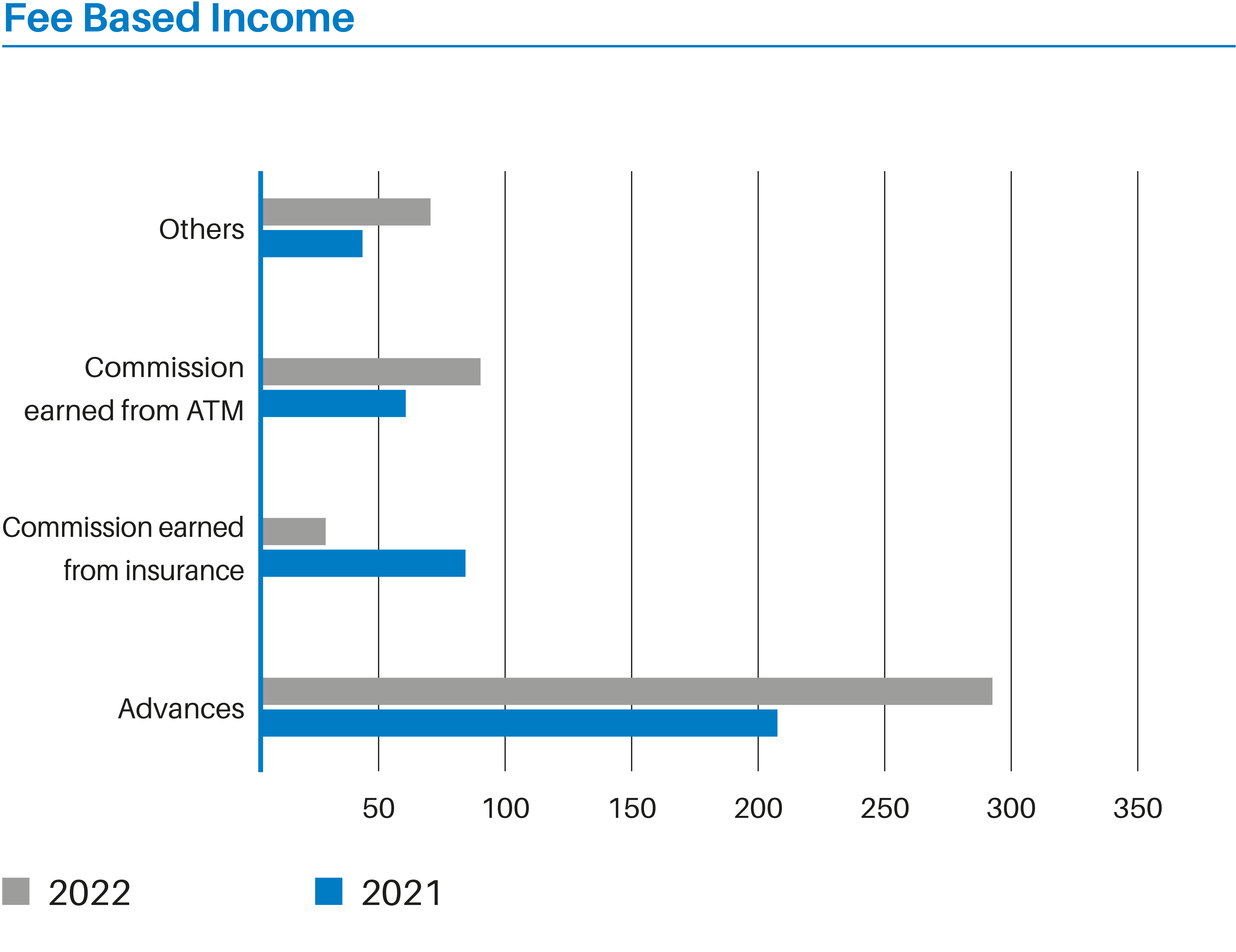

Fee-Based Income

Net fee and commission income, comprising fees related to loans and advances, debit cards, insurance-related services and electronic channels increased to Rs. 478 Mn in 2022 from Rs. 390.3 Mn reported in 2021. This year-on-year growth was driven by a substantial increase in fee-based revenues generated from advance related transactions, the sizable improvement in debit card business volumes, and higher volumes of online transactions made through SDB bank’s digital products in the year 2022.

Total Operating Income

Consequent to the improvements in net interest income and net fee and commission income, total operating income grew to Rs. 7.74 Bn compared to Rs. 7.44 Bn in 2021.

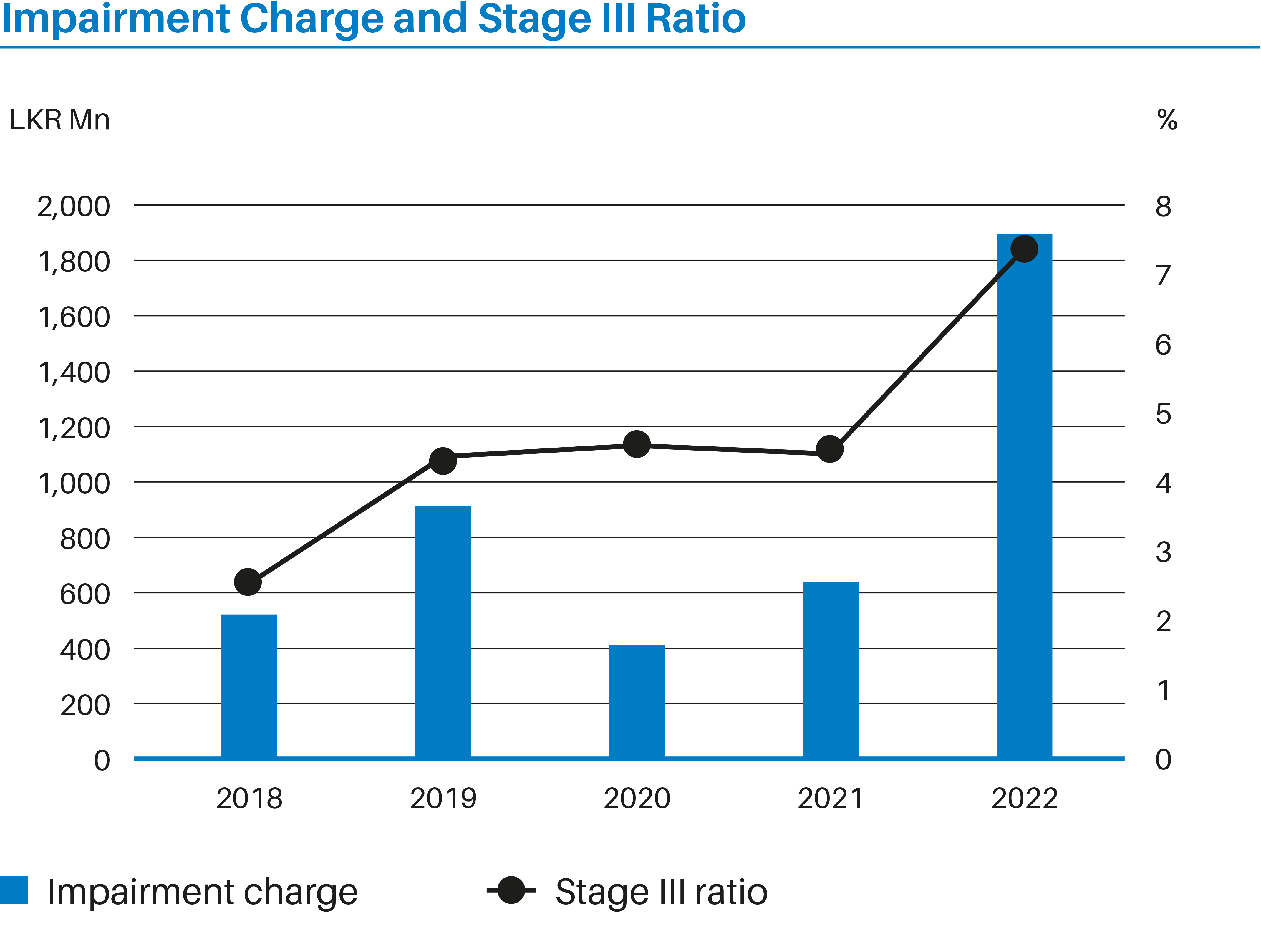

Impairment Charges

Impairment expenses increased by 195% year on year basis to Rs.1,898.4 Mn reflecting the vulnerable macroeconomic conditions of the country. During the year impairment models were revalidated and individually impaired loans were reassessed with the assistance of E&Y, our external consultants, to ensure that the bank is carrying correct impairment amounts in line with its asset quality.

Provisions made on stage 3 loans and other receivables increased from Rs. 309.7 Mn (2021) to Rs. 1,246.3 Mn (2022) which is an increase of over 300% when compared to the prior year.

The bank has sufficient provisions in view of the macroeconomic head winds, locally and internationally.

Operating Expenses

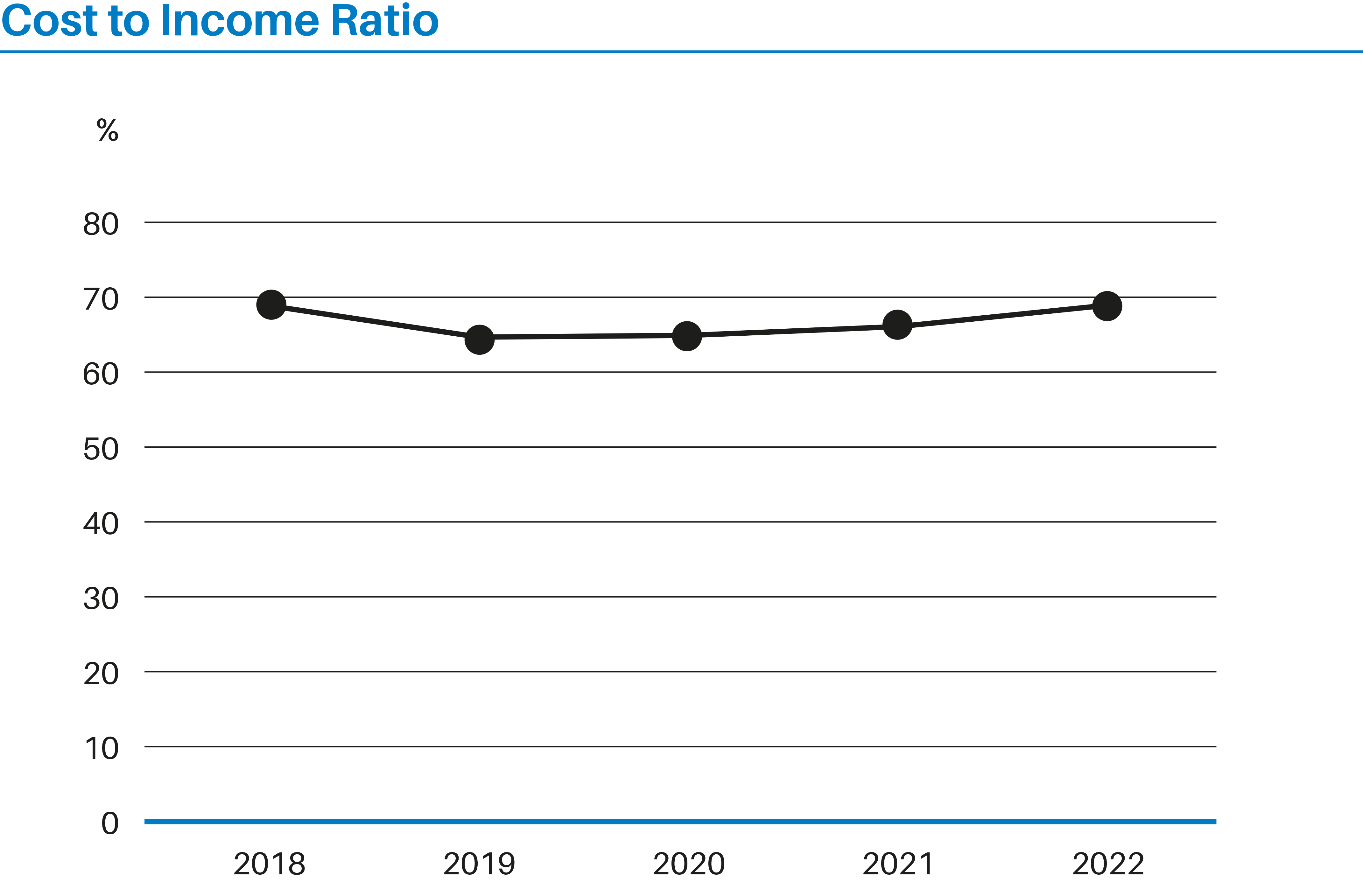

Total operating expenses at Rs. 5,365.7 Mn effects a year on year increase of just 9% despite the exponential growth in inflation. The increase stems mainly from personnel expenses and the increase recorded in other operating expenses.

Personnel expenses increased by 15.6% in line with the collective agreement with the Bank’s employee union and the salary increments granted to the bank staff. In addition to that a one-time ex-gratia payment made to the entire staff contributed to the above increase.

Other contributory factors to operating expenses increase was the office administration and establishment expenses due to the inflationary pressure that prevailed in the market in the second half of the year. Despite these increases the Cost to Income ratio was maintained below 70%.

Taxation

The Bank applied the revised rate of 30% and other amendments in line with the Inland Revenue Amendment Act No. 45 of 2022 to calculate the income tax and deferred tax assets/liabilities as of 31st December 2022. An increased tax rate was applicable for six months of the year of assessment.

For the first six months of the year of assessment commencing on April 1, 2022, the rate was 24% and for the next three months of the same year of assessment the rate was 30%.

Surcharge tax relevant for the year of assessment 2020/2021 was paid during the financial year 2022 amounted to Rs. 521.6 Mn and adjusted to retained earnings.

The reduction in VAT on financial services and income tax expenses are directly correlated to the change in profitability for the year.

Social security contribution levy was introduced during the financial year 2022 and Rs.17.9 Mn was provided for same during the financial year ended 31st December 2022.

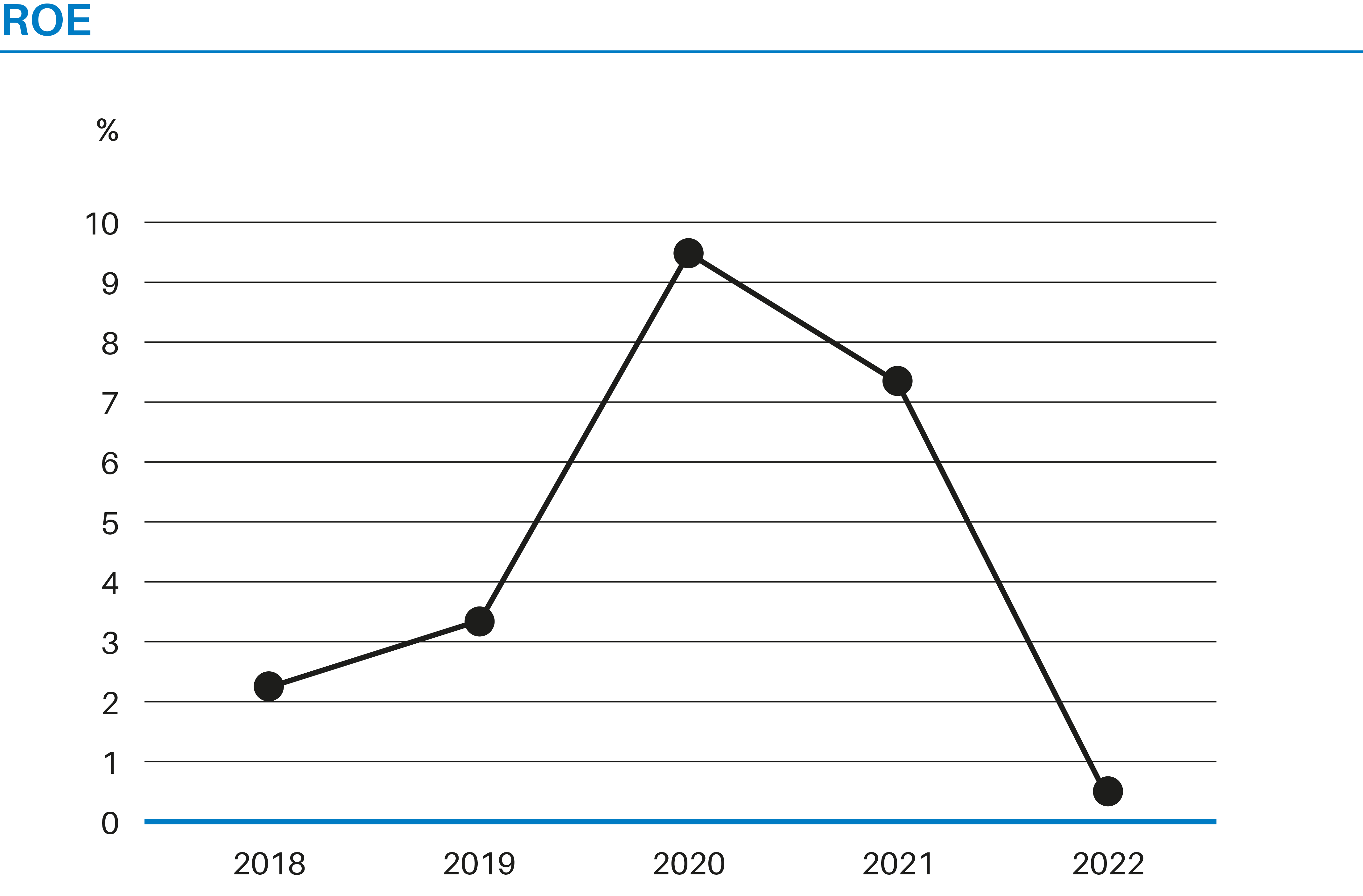

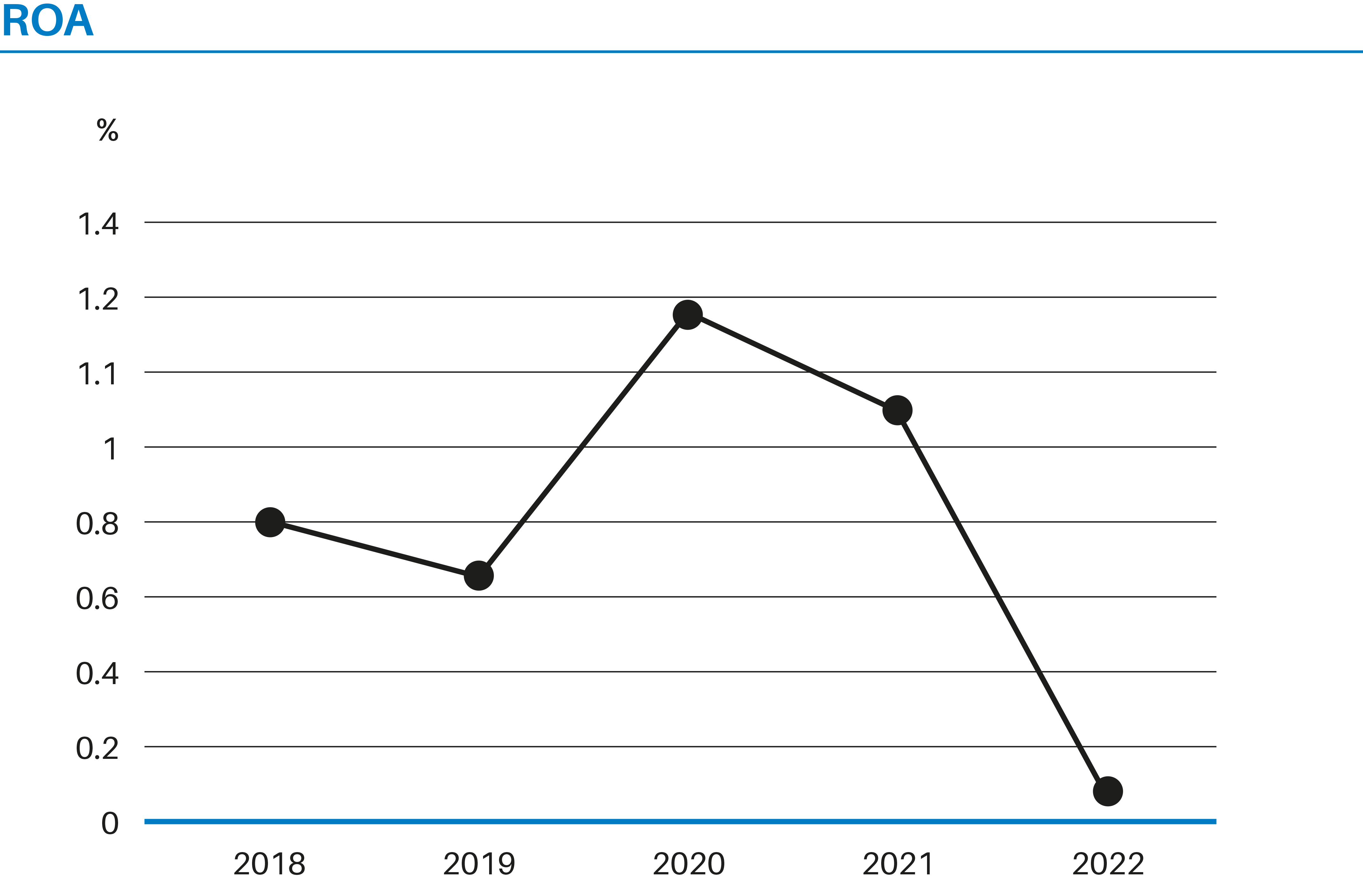

Profitability

The bank reported a profit before tax (PBT) of Rs. 96.96 Mn for the year 2022, against Rs. 1.33 Bn recorded in 2021. Profit after tax (PAT) for the year under review also declined to Rs. 61.2 Mn from Rs. 883.3 Mn registered in the previous year mainly due to the macroeconomic situation prevailed in the country which is reflected in the Rs 1.25 Bn increase in impairment charges.

Net interest margin (NIM) decreased to 4.9% in 2022 against the prior year’s figure of 5.47% due to the upwards pressure on deposit pricing and measured re-pricing of the loan portfolio.

Other Comprehensive Income

Other comprehensive income of the Bank reported a profit of Rs. 292.2 Mn during the year, as against the profit of Rs.909.3 Mn reported in 2021, primarily due to the revaluation of lands amounting to Rs. 259 Mn and other adjustments due to reassessment of the retirement benefit liability of the Bank for the period ended December 31, 2022.

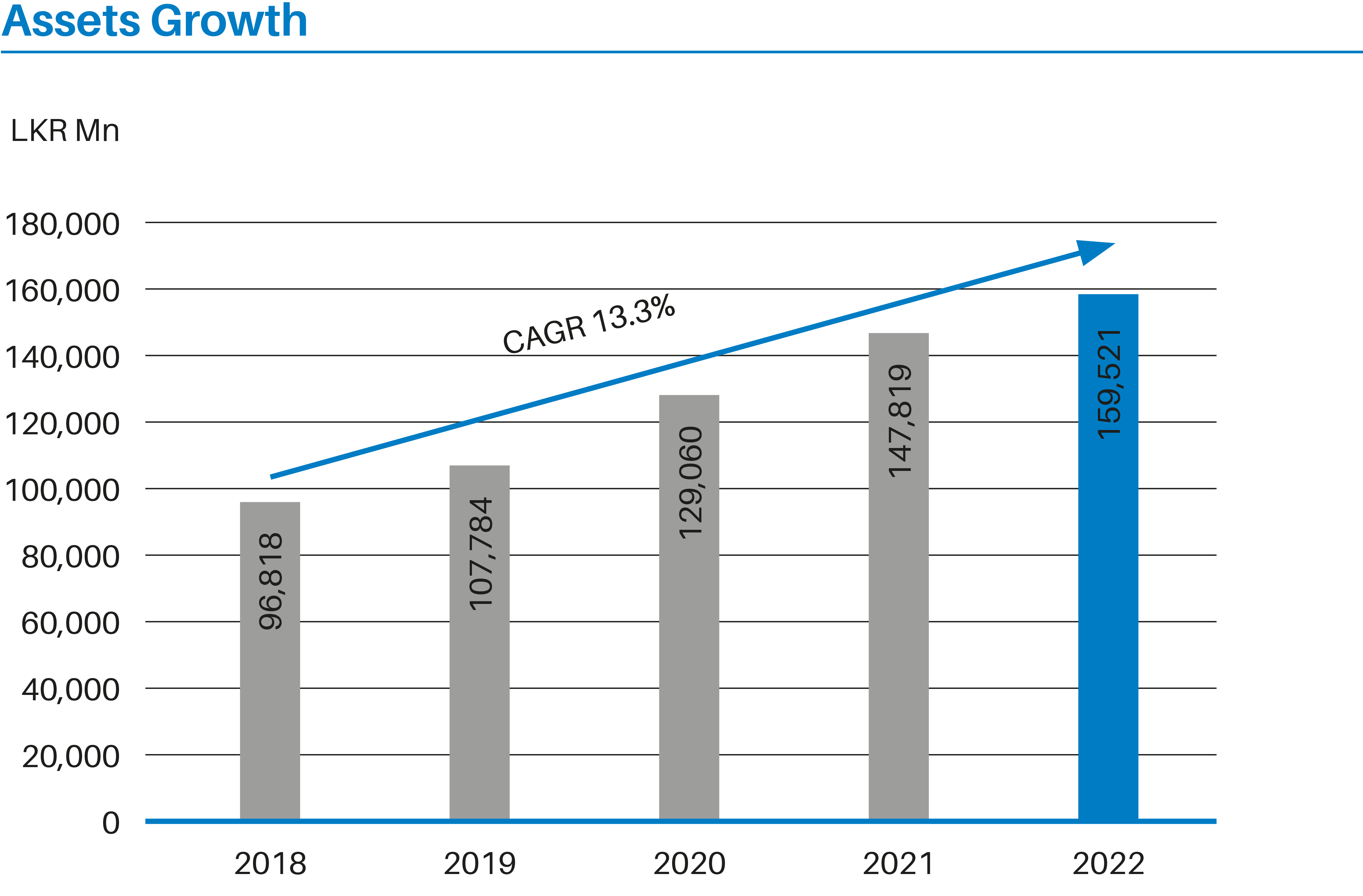

Analysis of the Statement of Financial Position Assets

The total assets of the Bank grew by almost 8% during the year to reach Rs. 159.5 Bn from Rs. Rs. 147.82 Bn at the previous year end. The increase was mainly in higher investment in Government securities from Rs.11.2 Bn in 2021 to Rs. 19.2 Bn in 2022.

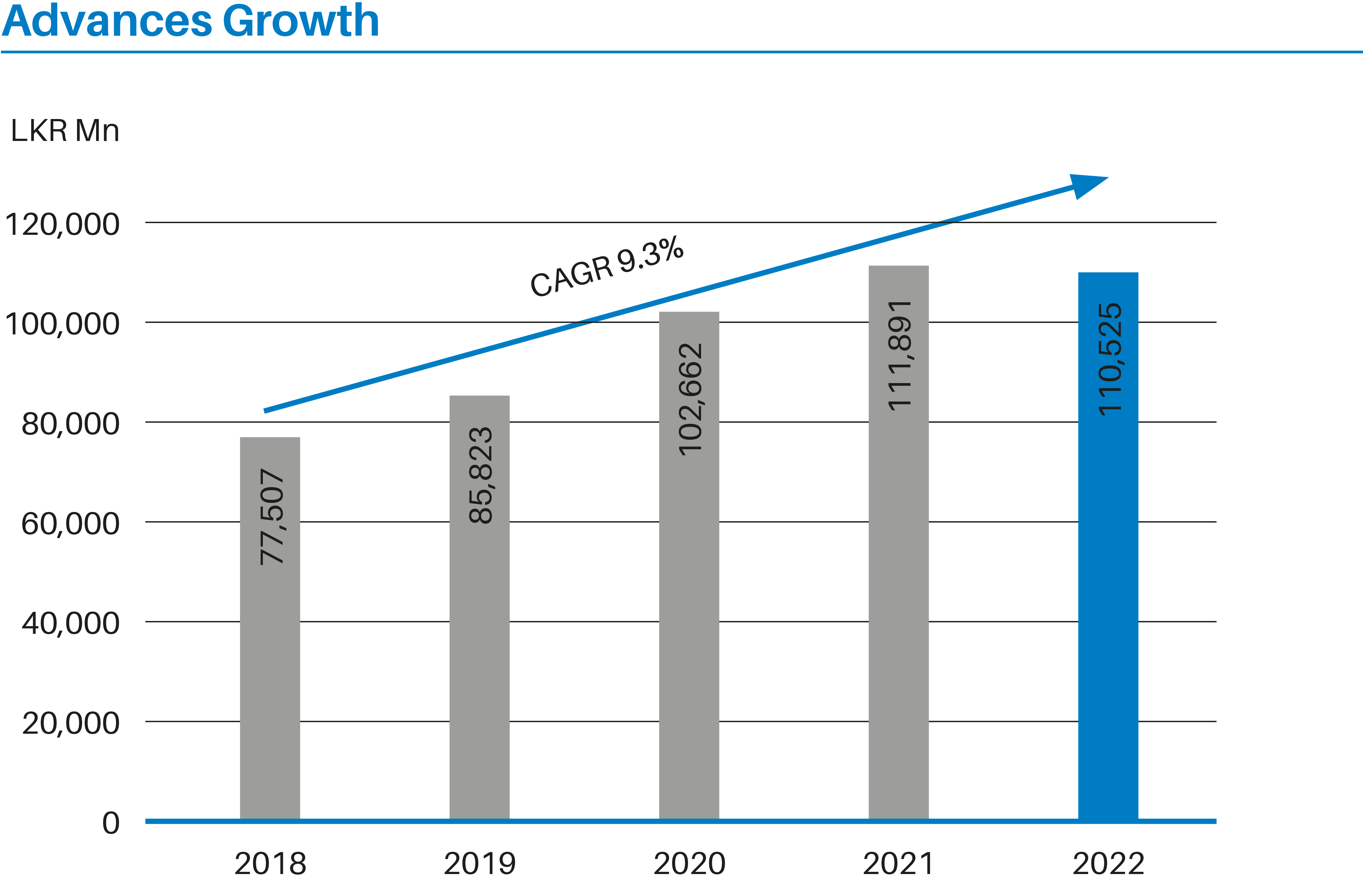

Loans and Advances to Customers

The total assets of the Bank grew by almost 8% during the year to reach Rs. 159.5 Bn from Rs. Rs. 147.82 Bn at the previous year end. The increase was mainly in higher investment in Government securities from Rs.11.2 Bn in 2021 to Rs. 19.2 Bn in 2022.

Asset Quality

Considering the long-term sustainability of the Bank’s operations, the impairment provision has been increased from Rs. 643.7 Mn (2021) to Rs 1,898.5Mn (2022) in line with the vulnerable economic conditions of the country.

Deposits

Customer deposits continued to be the single most significant source of funding for the Bank, accounting for 73.7% of the total liabilities as of December 31, 2022. The Bank’s deposit book surpassed Rs.100 Bn mark during the year and reported Rs 107.5 Bn as of December 31, 2022, with a year-on-year growth of 14.5%, driven mainly by Fixed deposits.

Capital

The Bank is guided by its Internal Capital Adequacy Assessment Plan (ICAAP) in maintaining capital corresponding with its current and projected business volumes. The number of issued shares as of the reporting date was 160,698,832. The total equity of the Bank has reduced by Rs 762.65 Mn as a result of surcharge tax and dividend payment made for the FY 2021 amounting to Rs.521.6Mn & Rs.241.05Mn respectively and adjusted to the opening balance of the retained earnings during the year to reach Rs 13.659 Bn at the end of 2022.

SDB bank maintained all its capital ratios well above the regulatory requirements throughout the year. As of December 31, 2022, the Bank’s Tier I and Total capital ratios were at 12.92%, and 15.37%, compared to 13.16% and 15.78%, respectively, at the end of 2021.

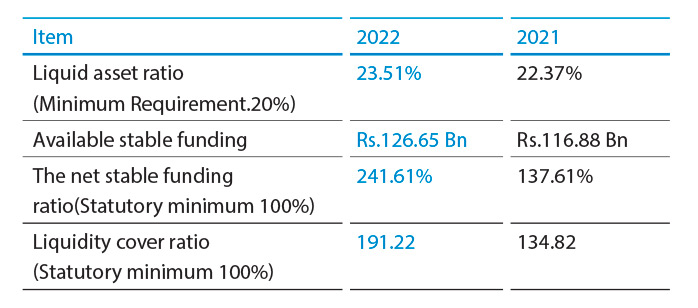

Liquidity

At a time of unprecedented volatility such as what we currently experience, excess liquidity provides a high level of comfort to the Bank. It enables the Bank to benefit from the upturn envisaged in credit demand in the years ahead. Given its importance, a review of liquidity is a permanent item on the agenda in the ALCO meetings of the Bank. The below table shows the improvement the Bank had made in terms of liquidity when compared to the previous financial year.