Management Discussion and Analysis

Natural Capital

Managing the Internal Footprint

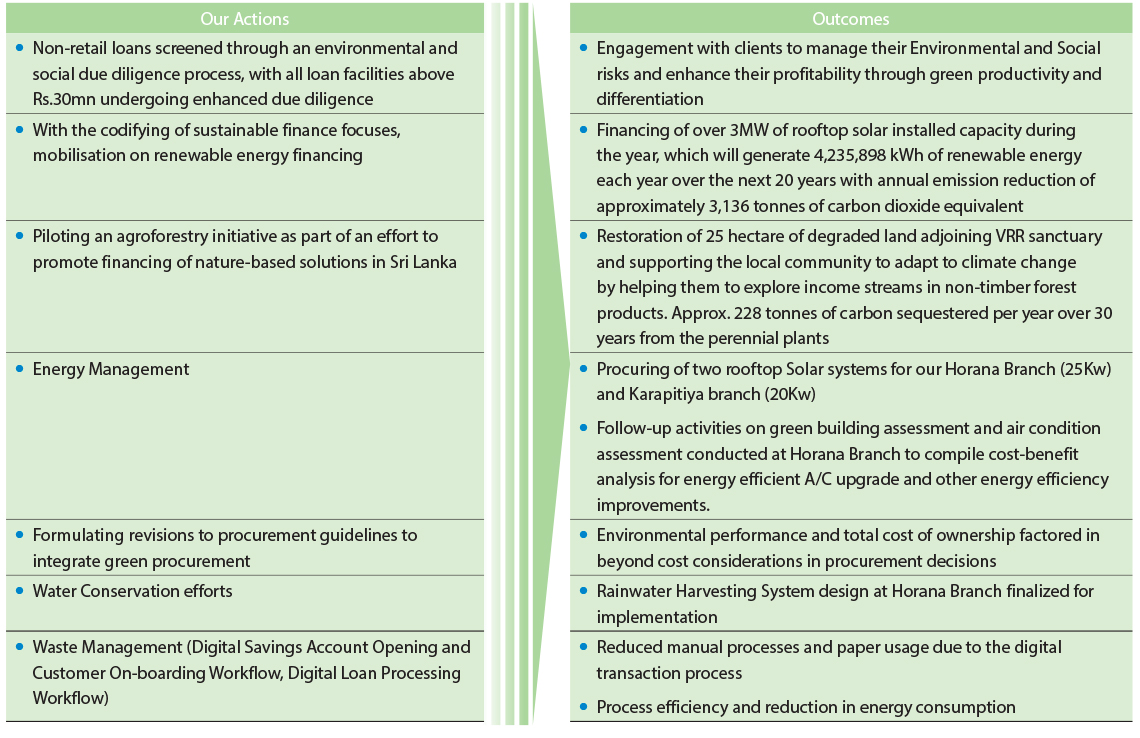

With regards to internal environmental footprint management, in FY2021, the Bank adopted an approach to pilot and demonstrate the value of environmentally friendly initiatives. This focus continued in FY2022, with the procurement of solar rooftop systems for Horana and Karapitiya branches and the designing of rainwater harvesting system at Horana branch. Based on the energy audit and A/C assessment conducted in FY2021 with the support of consultant, Co-energi, and the Green Building preliminary assessment carried out by GBCSL accredited professionals at the Horana branch, the Bank had mobilized to compile a cost/benefit analysis for upgrades and retrofits to the Horana branch. However, the economic conditions that prevailed post-April 2022 made such investment cost-prohibitive with the escalation of prices of capital equipment. Therefore, the A/C upgrade had to be put on hold and would be re-considered during FY2023/24.

Despite the cost escalations, the Bank proceeded on the procurement of two solar PV rooftop systems for Horana and Karapitiya branches, where the installations are currently in progress. These two installations, which together constitute 45KW of installed capacity would contribute to reduction of approx. 866 tonnes of CO2 equivalent over the 20-year power purchase agreement.

Solar Rooftop System installation at Horana Branch underway

SDB bank continued to implement energy saving measures by rationalising the use of office space and releasing several office buildings that had been rented. Work from home arrangements and floor-based work rosters were implemented at the head office and across some central operations, where the power-downs of selected floors was implemented based on the roster.

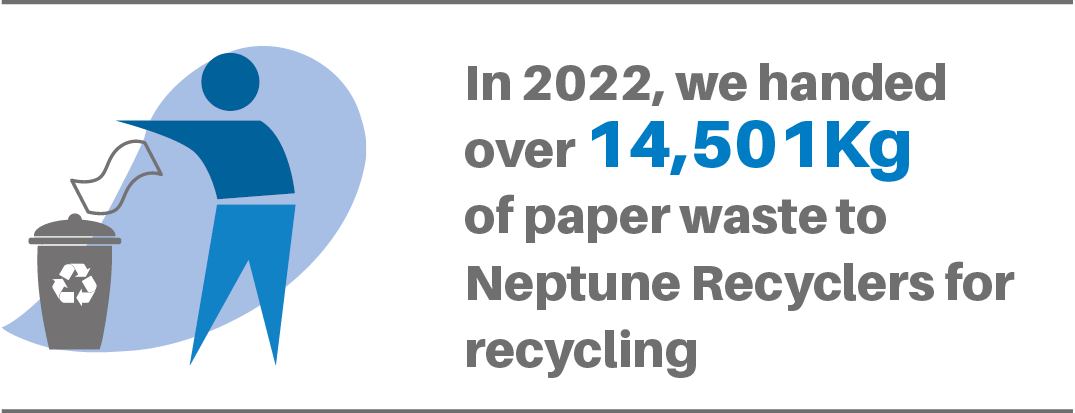

The Bank also continued the practice of handing over paper waste from operations in the Western Province to Neptune Recyclers. We have also been communicating internally via e-flyers on sustainability practices including on electricity use and food waste.

With pilots implemented, we hope to demonstrate the sustainability practices with the regional sustainability teams that have been constituted to scale these solutions within its branch network.

Environment and Social Risk Management Framework (ESMS) and Sustainable Finance

The Bank had commenced to operationalize an Environmental and Social Risk Management System (ESMS) from September 2021 commencing with environmental and social due diligence assessment for all non-retail loans. With the onset of the poly-crisis, the Bank had to curtail new lending. The fuel shortages and other disruptions also made physical inspections of client operations more challenging. However, the Bank’s relationship officers continued to assess client operations in using the environmental and social due diligence checklist that the Bank had developed with the support of IFC and ADB. Senior Manager – Sustainable Banking conducted enhanced due diligence of several large clients in coconut-based product manufacturing and export and in FMCG product manufacturing and distribution. The Bank engaged with clients to address risks and leverage sustainable business practices for profitability.

Post-disbursement reviews in December 2022 had identified areas for further improvement in ESMS implementation including the need for regular portfolio level visibility on E&S risks. A key aspect is the integration of the Environmental and Social Due Diligence questionnaire to the Bank’s Loan Origination System along with improvements needed to capture data on Bank’s alignment to the Green Finance Taxonomy for Sri Lanka that the Central Bank of Sri Lanka had declared in May 2022.

Based on business level KPIs set on Bank’s sustainable finance focuses, we mobilized in leveraging partnerships. On e-mobility, the Bank had conducted a demo of electric bicycles for its staff including its leasing sector staff in collaboration with RHODA in March 2022. As part of the engagements on circular economy, we initiated engagements with MAS Foundation for Change to discuss the modalities of awareness and capacity building for cooperatives in Southern region (tourist areas) to set-up material recovery facilities and commence upcycling businesses. In relation to sustainable agriculture, the Bank had partnered with the Agribusiness Development Division of the Department of Agriculture to promote the uptake among farmers of the Sri Lanka

Good Agricultural Practice (SLGAP) standards with organising of workshops. The Bank had also commenced engagements with Market Development Facility (MDF) during the year to enter into a strategic partnership for sustainable value chain development.

The strategic partnership with Hayleys Fentons entered into in FY2021 paved the way for the Bank to finance commercial scale Rooftop Solar PV Project [3MW in total at two sites in Colombo (1,854kWp) and Kandy (1,200kWp)] in July 2022. The Bank had also previously financed smaller scale residential systems prior to March 2022, however with the cost escalations, the proposition had become unviable for small scale installations. With the costreflective pricing being implemented by the utilities, the Bank will be exploring the opportunity to resume residential and commercial scale solar financing.

Partnering Sustainable Energy Solutions

The Bank facilitated engagements between the Solar Industries Association (SIA) and the Sri Lanka Banks’ Association’s Sustainable Banking Initiative (SLBA SBI) to work together to address bottlenecks in scaling solar financing including in advocating for green wheeling as a workaround for the financial challenges faced by CEB in making due payments to renewable energy developers.

Discussion between Solar and Banking industries facilitated by SDB bank

Research on Financing Nature Based Solutions

The Bank had commenced financing of value chains of certain perennial crops such as Kithul in FY2021 in partnership with certain cooperatives with the support of the Smallholder Agribusiness Partnerships Program (SAPP). As part of the Bank’s 25th anniversary commemorations, the Bank had intended to launch a flagship strategic sustainability initiative. With the decade 2021 to 2030 declared by the United Nations as the decade on ecosystem restoration, SDB bank envisaged to develop a landscape finance/ nature-based solution finance proposition by implementing a pilot agroforestry initiative to restore degraded ecosystem closer to a protected area.

The Bank had reached out to its partner cooperatives which were engaged in agribusiness and had assessed various sites for this restoration activity including several sites in Gilimale adjoining the Peak Wilderness Sanctuary. However, based on detailed assessments build on input from Forest Department, Department of Wildlife Conservation and Divisional Secretariats, the Bank had selected a site near the Victoria, Randenigala, Rantembe (VRR) sanctuary for restoration. Dumbara SANASA Union, a collective of cooperatives, with whom the Bank was already engaging on financing for agri-produce aggregation and value addition was selected as a key partner in this initiative alongside with IUCN Sri Lanka.

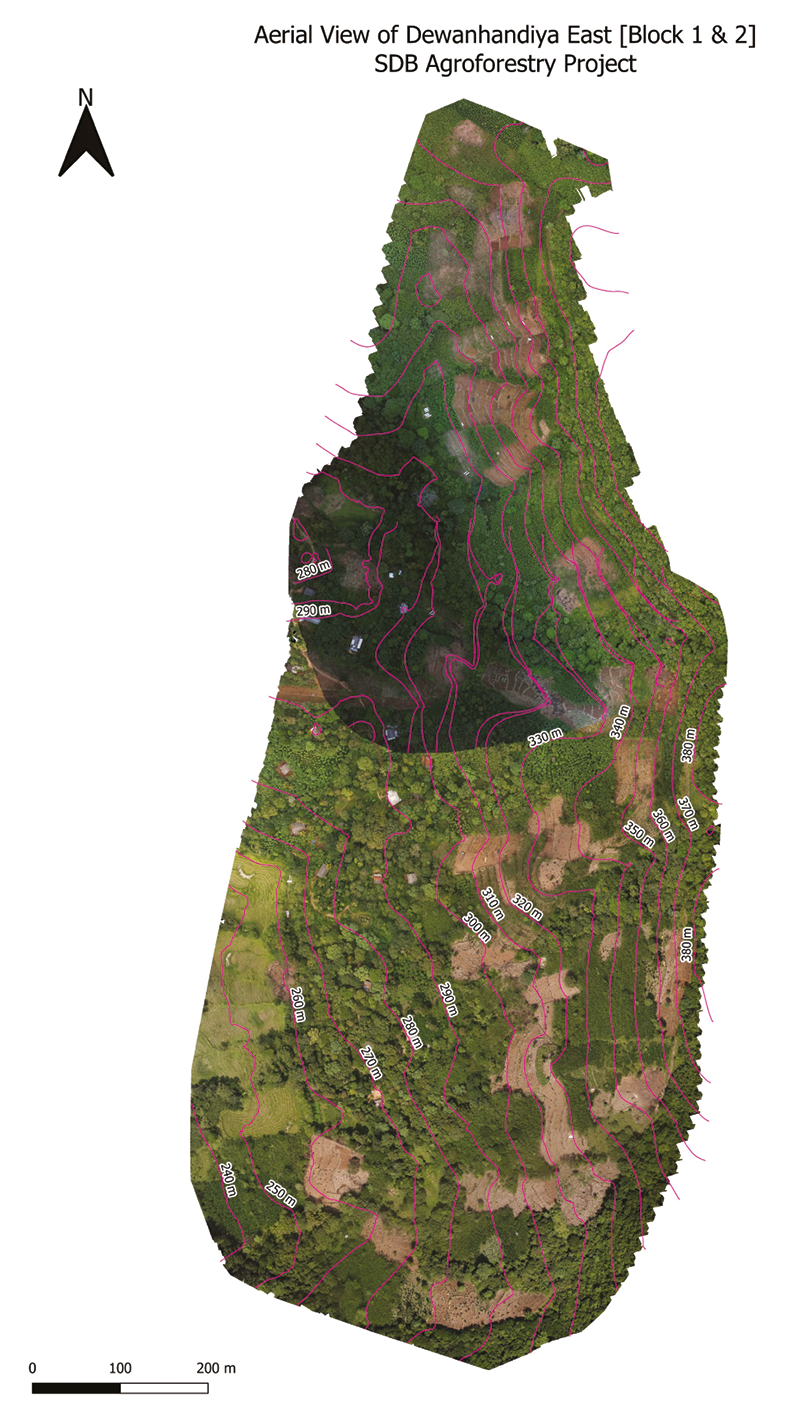

The site for this pilot agroforestry initiative was a 25 hectare degraded land in Dewahandiya East village in Ududumbara. This land area adjacent to VRR sanctuary had been degraded due to decades of tobacco cultivation in the mountain slope. The local population had phased out tobacco cultivation over time and replaced with vegetable cultivation. However, with the fertilizer ban/high input costs in 2021 and 2022, their production had been adversely affected. Over the past four years, the local community had also been impacted from climate change with rainfall variability affecting their pepper cultivation, which was a primary cash crop for the village. The area forms a part of the Randenigala Reservoir’s catchment area and had been identified for high soil erosion. During the dry seasons, this degraded area is engulfed with mana and poses a risk of being the cause of forest fire that could spread to VRR sanctuary. Therefore, based on making positive impact on biodiversity, climate action, land degradation neutrality and community resilience, the Bank initiated the agroforestry project in December 2022. The Bank partnered with multiple state agencies including Divisional Secretariat of Ududumbara, Forest Department, Department of Wildlife Conservation, Central Province Department of Agriculture, Department of Export Agriculture and Central Province Department of Ayurveda to name a few in implementing this initiative as a multi-stakeholder program with the local community being central to the program design.

Prior to initiating planting, the Bank commissioned scientific studies (geospatial and soil analysis). Based on inputs from experts and through multi-stakeholder consultations, inter-crop model with 10 types of perennial plants (Jackfruit, Bael fruit, Indian gooseberry, Coffee, Cinnamon, Bibile Sweet Orange, Lime, Mee, Bulu, Neem) were identified to be planted.

The Bank also conducted training programs for the local community in Sri Lanka Good Agricultural Practice (SLGAP) standards and on biochar and vermicompost production locally with the support of Department of Agriculture, Central Province Department of Agriculture and Department of Export Agriculture.

Planting commenced in August 2022 and continued till February 2023 where we succeeded in planting over 9,000 perennial plants. Staff from SDB bank also participated in the planting activities. A total of 84 farming families benefitted through this agroforestry initiative.

As a next step in this program, the Bank is working with the Dumbara SANASA Union to engage with the local community to develop value chains in these perennial crops and scale this agroforestry program to other regions. The Bank is currently engaging with the USAID Climate Adaptation program with the intent of developing the capacity of cooperatives to be robust aggregators in export-oriented value chains. The data and knowledge gathered through this pilot project would support the Bank to attract international sustainable finance to Sri Lanka and the Bank remains keen to support the Government of Sri Lanka in implementing nature-based solutions as part of a debt for nature swap.

Training on Biochar and Vermicompost production further to SLGAP training

25th Anniversary Reforestation Project