Bank Overview

Financial Highlights

| For the year ended 31st December | 2022 LKR |

2021 LKR |

Change |

| Financial performance | |||

| Gross Income | 22,034,136,119 | 15,477,595,919 | 55% |

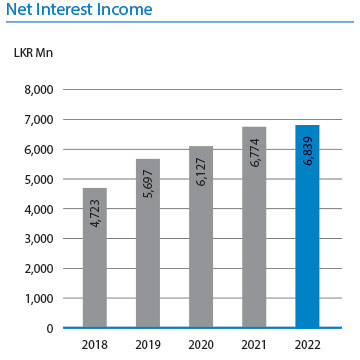

| Interest income | 23,101,048,459 | 14,792,068,260 | 56% |

| Interest expenses | 16,261,994,676 | 8,018,419,381 | 103% |

| Profit before tax | 96,957,128 | 1,329,807,785 | -93% |

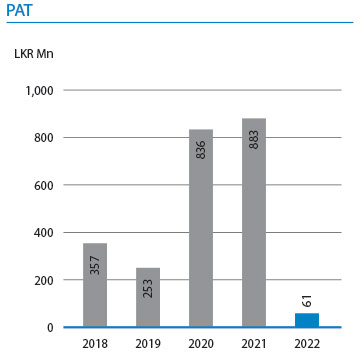

| Profit after tax | 61,166,336 | 883,278,171 | -93% |

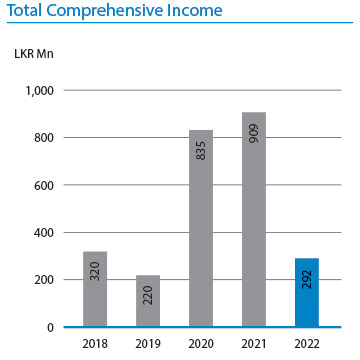

| Total comprehensive income | 292,179,813 | 909,346,725 | -68% |

| Financial position at the year end | |||

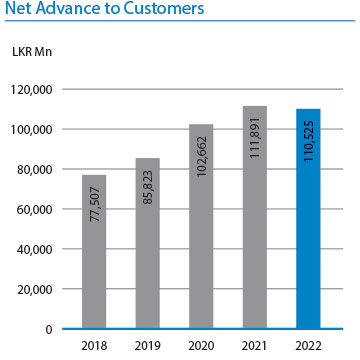

| Net advance to customers | 110,525,450,192 | 111,891,255,619 | -1% |

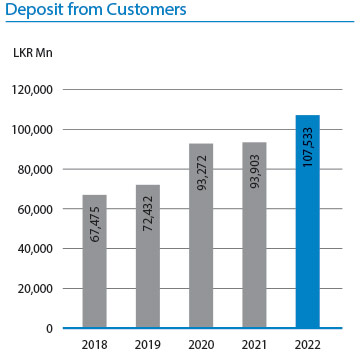

| Deposit from customers | 107,533,001,772 | 93,902,939,217 | -15% |

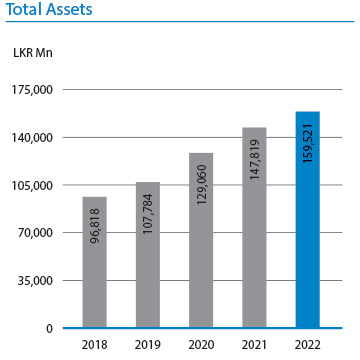

| Total assets | 159,521,031,879 | 147,818,916,072 | -8% |

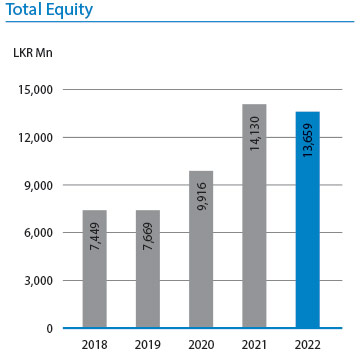

| Total equity | 13,659,214,913 | 14,129,696,530 | -3% |

| Growth in advances | -1.22% | 8.99% | |

| Growth in deposits | 14.52% | 0.68% | |

| Investor information | |||

| Earnings per share (Rs.) | 0.38 | 7.63 | |

| Net assets per share (Rs.) | 85.00 | 88.00 | |

| Market value per share (Rs.) | 21.40 | 43.00 | |

| Price earning ratio (times) | 56.31 | 5.64 | |

| Ratios | |||

| Net interest margin-% | 4.90 | 5.47 | |

| Return on assets (ROA)-% | 0.06 | 0.96 | |

| Return on equity (ROE)-% | 0.44 | 7.35 | |

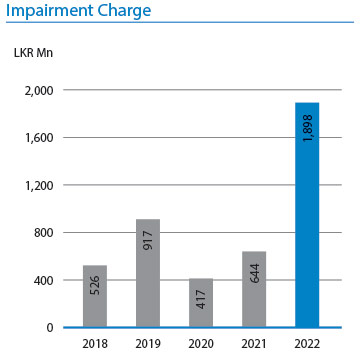

| Stage III impairment ratio-% | 7.36 | 4.42 |