Operating Environment and Strategy

Materiality

Material matters are those issues that can potentially impact the Bank’s financial performance and social license to operate as well as its ability to create value for the stakeholders over the short, medium and long term. These material matters are identified based on the feedback received from our stakeholders and the changing operating environment which may pose risks and opportunities affecting the Bank's operations. These material issues (economic, social and environmental factors) are assessed annually to determine their significance and address them appropriately to manage their impacts. There are no significant changes to the list of material topics and topic boundaries compared to the previous year.

Determining Materiality

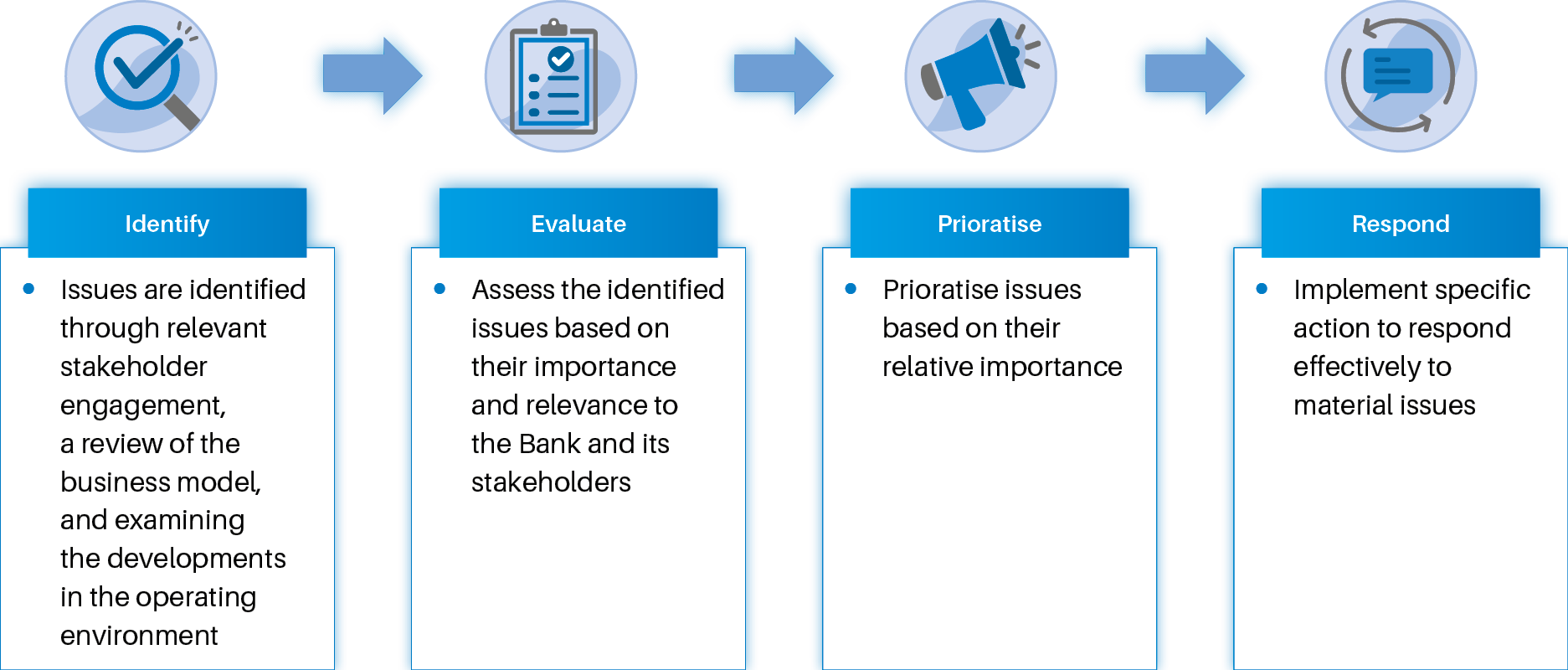

We have followed the following steps in determining material topics relevant to SDB bank.

Material Aspects Relevant to SANASA Development Bank

| Aspect/Material Topic | Material Matters of Concern to SDB bank | Level of Importance | SDGs | |||

| To Stakeholder |

To The Bank |

|||||

| 1 | Finanacial performance and the profitability | Ensure continued growth and profit generation under the current uncertain operating environement | H | H | ||

| 2 | Customer Service | Maintain enhanced customer service to retain a satisfied customer base | H | H | ||

| 3 | Customer privacy | Protection of customer information to increase customer confidence | H | H | ||

| 4 | Responsible lending | Practice fair and responsible lending to avoid unsustainable financial decisions/agreements | H | H | ||

| 5 | Inclusive lending | Provide access to affordable and quality financial services for rural masses | H | H | ||

| 6 | Operational efficiency | Resource optimisation to achieve business objectives | M | H | ||

| 7 | Employee skill development | Having a skilled and competitive workforce that will provide the competitive edge that is necessary to drive growth | H | H | ||

| 8 | Environmental consciousness | Ensure commitment to preserve the environment to minimise its impact on climate change, adopt initiatives for the same | M | M | ||

| 9 | Facilitating digital inclusion | Provide access to digital banking facilities for the rural masses | H | H | ||

| 10 | Corporate Social Responsibility | Contribute to uplift the communities to encourage their economic progress | M | M | ||

| 11 | Right talent acquisition and retention | Aquire the right talent and skills drive sustinable growth of the Bank | M | H | ||

| 12 | Regulatory environment | Changes in the regulatory environment may pose threats or opportunities | M | H | ||

| 13 | Forming Partnerships | Forming buisness alliances will create better opportunities and situations for value creation | M | M | ||