Risk Management and Corporate Governance

Corporate Governance

Our Approach

At SDB bank, Corporate Governance incorporates the system of rules, practices, and processes that direct and manage the Bank towards long-term value creation for its stakeholders sustaining its continued growth. Hence, the Bank's Board of Directors hold the primary responsibility for formulating policy frameworks and executing robust governance practices in effectively driving the Company's strategic objectives. These governance practices are regularly reviewed and updated based on the regulatory amendments, risks and opportunities in the operating environment as well as internal adjustments. The SANASA Movement has established the foundation for the Bank's ethical conduct that is built upon the corporative principles of empowerment, equal opportunity, and collective participation in decision-making.

The Bank’s Corporate Governance framework has been fundamentally built on the following requirements and guidelines (listed below) and we continuously review our corporate governance practices on par with the specified standards.

External Frameworks/Standards

- Companies Act No. 07 of 2007

- Banking Act No. 30 of 1988 and amendments thereto

- Banking Act Direction No. 12 of 2007 of the Central Bank of Sri Lanka on “Corporate Governance for Licensed Specialised Banks in Sri Lanka” and amendments thereto

- Code of Best Practice on Corporate Governance issued by The Institute of Chartered Accountants of Sri Lanka (a Voluntary Code)

- Listing Rules of the Colombo Stock Exchange

- Securities and Exchange Commission of Sri Lanka Act No. 36 of 1987 and amendments thereto

- Financial Transactions Reporting Act No. 06 of 2006

- Prevention of Money Laundering Act No. 05 of 2006

- Convention on the Suppression of Terrorist Financing Act No. 25 of 2005

- Inland Revenue Act No. 24 of 2017

- Road-map for Sustainable Finance in Sri Lanka

- Recommendations from Task Force on Climate-Related Financial Disclosures (TCFD)

- Developing a Body of Knowledge from the Task Force on Nature-Related Disclosures (TNFD

Internal Frameworks/Standards

- Articles of Association of the Bank

- Board-approved policies on all major operational aspects

- Customer Charter

- Policy for the secrecy of information, Related Party Policy, credit and other internal manuals

- Integrated Risk Management Procedures

- Code of Conduct and Ethics for Directors

- Disclosure policy, Communication policy

- Processes for internal controls

- Compliance Charter, Compliance Policy and procedure manual for Know Your Customer and Customer Due Diligence lead to the prevention of money laundering and terrorist financing

- Internal circulars on operational practices

- Governance Framework on Sustainability

Governance Structure

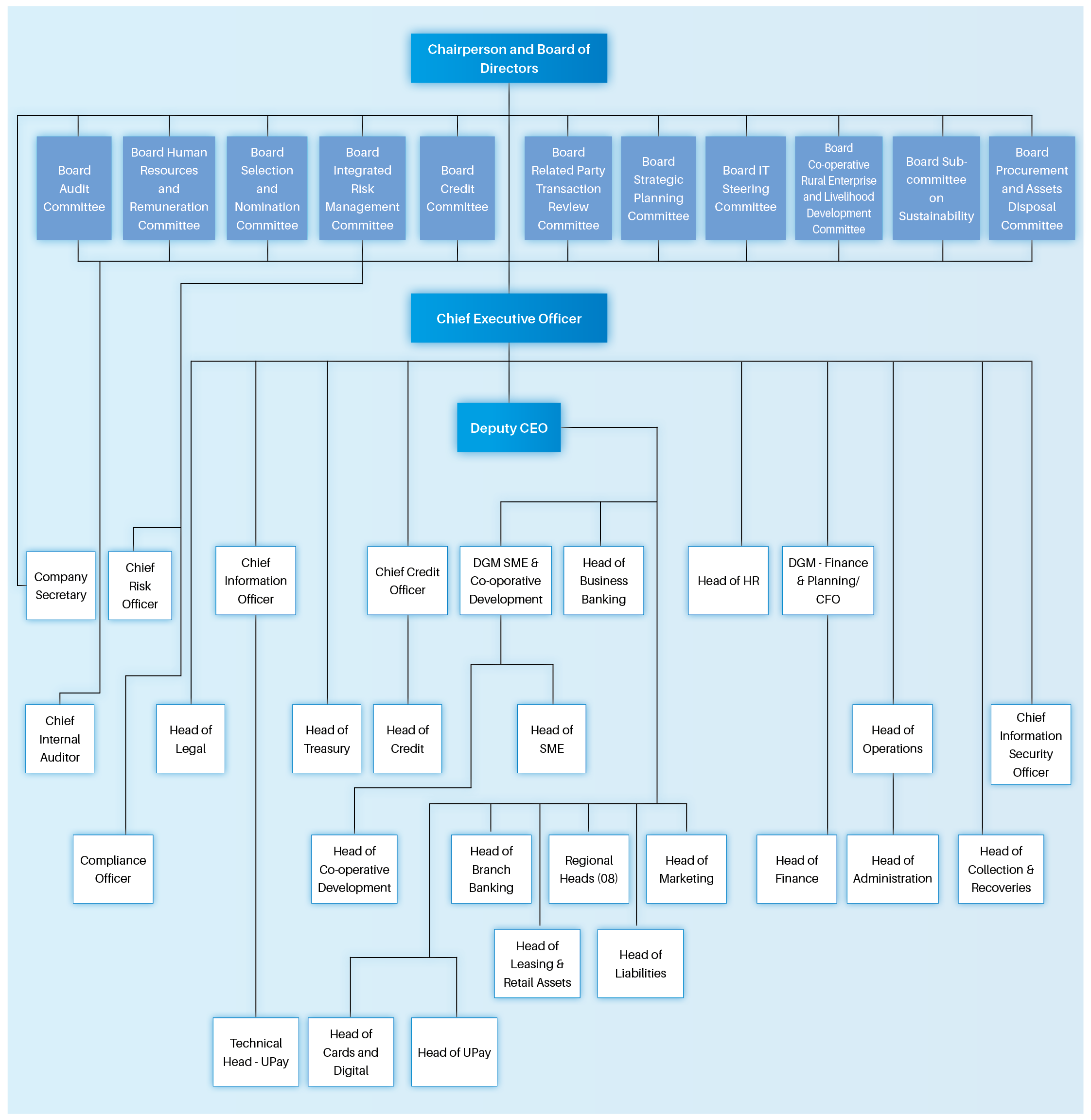

The Board of Directors which is led by an Independent, Non-Executive Chairperson holds supreme accountability and responsibility for the affairs of the Bank. In this endeavour, the Board is supported by eleven subcommittees, which provide supervision with intense focus on specific areas, enabling the Board to commit sufficient time and focus on broader issues within its scope.

Board of Directors

Board Composition

- 13 non-executive directors of which 5 are independent.

Board Diversity and Effectiveness

- The Board brings forth diverse industry experience and knowledge that enable the evaluation of matters from a varying perspectives strengthening the outcome of discourse.

- Have expertise in the field of academics, rural development, administration, entrepreneurship and cooperatives.

- Strong financial acumen on the Board with a Director holding membership in professional accounting bodies and several directors holding MBAs from reputed universities

- A one Director is a PhD holder and BAC Chairman holding a membership in professional accounting body and several Directors holding MBAs from reputed universities.

Appointment to the Board

- New directors are appointed through a transparent procedure.

- Nominations for the vacancies are made through the Board Selection and Nomination Subcommittee (BS and NC) as per the criteria laid down by the Banking Act

- The nominated person provides an affidavit of authenticity and the details are communicated to the CBSL for Fit and propriety approval.

- Appointments are thereafter communicated to the CSE and shareholders through press releases.

Balance of Power

There is a clear segregation of responsibilities between the Chairperson and the CEO to facilitate the appropriate balance of power and authority which is important for sound governance. Therefore, we have established a clear distinction between the role of the Chairperson and the CEO.

Chairperson

- Provides leadership to the Board

- Ensures effective functioning through setting up the Board’s annual work plan and agenda, timely meetings for clear and accurate information sharing

- Monitors the overall effectiveness of the Board

CEO

- Leads the bank towards the achievement of strategic objectives

- Monitor and report the Company’s performance to the Board

Board Remuneration

The remuneration of the Board of Directors and the Key Management personnel is determined based on the formal Remuneration Policy that is formulated to attract, motivate and retain high performing senior professionals. The Board Human Resource and Remuneration Committee is vested with the responsibility of guiding the Board of Directors and the Senior Management within agreed terms of reference and in accordance with the remuneration policies of the Bank.

Board Access to Information

The Board of Directors have unrestricted access to the Bank's Management team and other information resources that are vital to the effective execution of their responsibilities. For this purpose, the Management makes regular presentations to the Board to keep the directors well-informed of emerging trends in the operating landscape. The Board of Directors can also seek independent professional advice that can be coordinated through the Company Secretary.

The Board participate in seminars conducted by the Sri Lanka Institute of Directors as well as forums organised by the CBSL.

Board Meetings

The Board met 20 times in 2022 and the details of meeting attendance are given in the Annual Report of the Board of Directors on the Affairs of the Company on page 157. Notices of all Board meetings (except Emergency Board meetings) are given at least seven days prior to the holding of the meeting, thereby providing the members with adequate time for preparation. Likewise, meeting agendas and Board papers are circulated to all Board members prior to the meeting. Directors are supplied with comprehensive and timely information that is required for the effective discharge their duties.

Board Assessment

The Board and individual Directors engage in annual selfassessments to identify the potential areas for improvement in their performance and efficiency. This evaluation focuses on the Board as a whole as well as the performance of each director and is carried out based on the requirements of the Securities and Exchange Commission (SEC) and CA Sri Lanka. Areas such as Board composition, access to information, team dynamics and training opportunities are considered in self-assessment. Further, the members of the subcommittees are also annually assessed for the effectiveness of their performance.

Sub Committees of the Board

The Board has established mandatory Board Subcommittees and voluntary Board Subcommittees to assist the Boards. The composition of both mandatory and voluntary Board Subcommittees, as of 31 December 2022 is given in the Annual Report of the Board of Directors on the Affairs of the Company on pages 148 to 151.

Accountability and Audit

The Board is responsible for presenting a balanced and accurate assessment of its financial performance and position. The Bank’s Financial Statements are prepared in accordance with the Sri Lanka Financial Reporting Standards laid down by The Institute of Chartered Accountants of Sri Lanka. Furthermore, the Company’s Annual Report conforms to the GRI Standards on sustainability reporting, prescribed by the Global Reporting Initiative and the Integrated Reporting Framework published by the International Integrated Reporting Council. Directors' responsibility with regard to Financial Statements is given on page 167 of this Annual Report.

Risk Management

The Board is responsible for formulating the measures, tools, processes and policies to ensure that the Bank’s risk exposures are managed within defined parameters. The Board Integrated Risk Management Committee assists the Board in the discharge of its duties related to risk management. The Bank’s risk management framework has been formulated to comply with the requirements of the Banking Act and the Guidelines of the CBSL. Detailed disclosures on the Company’s key risk exposures and how they were managed during the year are given on pages 86 to 94 of this Report.

External Audit

The Board Audit Committee is responsible for overseeing the financial statements and reporting and makes recommendations to the Board regarding the appointment, service period, audit fee and engagement period of External Auditors. The Board has adopted a policy of rotating External Auditors every five years. Auditors submit an Annual Statement confirming independence as required by the Companies Act No. 07 of 2007. Non-audit services are not provided by External Auditors.

Board Subcommittee on Sustainability

The Board Subcommittee on Sustainability was set up in FY 2021 to integrate ESG into the bank's decision-making and performance management. This governance framework is aligned with the recommendations of the Roadmap for Sustainable Finance and the Sri Lanka Banks’ Association’s Sustainable Banking Initiative. This Subcommittee will review the integrated strategy, risk management and metrics and targets on sustainability including TCFD and TNFD standards.

Good Corporate Citizenship

The Bank has established the following standards for reinforcing the ethical conduct of the Bank’s employees:

The SDB bank Code of Conduct: The Code sets out the ethical behaviour expected from employees in dealing with other stakeholders and in their day-to-day operations, as well as administrative and grievance procedures. The Code of Conduct has been formulated in line with the Monetary Board’s Customer Charter and the Secrecy Provision in the Banking Act. All employees are provided with a copy of the SDB bank Code of Conduct upon recruitment.

Whistle-blowing Policy: The Bank has a Board-approved Whistleblowing Policy that enables any person, including a member of staff to report unlawful or unethical behaviour while protecting their anonymity.

COMPLIANCE WITH THE PROVISIONS OF THE BANKING ACT DIRECTION NO.12 OF 2007 OF THE CENTRAL BANK OF SRI LANKA

| Guideline | Function of the Board | Level of Compliance | Complied/ Not Complied | ||||||||||||||||

|

3 (1) (i) |

The Board shall strengthen the safety and soundness of the Bank by ensuring the implementation of the following: |

||||||||||||||||||

|

(a) Ensure that the Board-approved strategic objectives and corporate values are communicated throughout the Bank. |

Strategic objectives and corporate values were approved by the Board of Directors for 2022-2025 and communicated to all employees through meetings covering all employees and staff and frequent meetings with the Corporate and Senior Managers. |

Complied with |

|||||||||||||||||

|

(b) Overall business strategy including the overall risk policy and risk management procedures and mechanisms with measurable goals. |

The Bank’s current Strategic Plan includes measurable goals and there is a Board-approved risk management policy which defines risk-related procedures and tools for identification, measurement and management of risk exposures. |

Complied with |

|||||||||||||||||

|

(c) Identify the principal risks and ensure implementation of appropriate system to manage the risk prudently. |

The Board has delegated its risk-related functions to a dedicated committee, namely the Board Integrated Risk Management Committee (BIRMC) and its findings are submitted on a monthly/quarterly basis to the main Board for review. |

Complied with |

|||||||||||||||||

|

(d) A policy of communication is available with all stakeholders, including depositors, creditors, shareholders and borrowers. |

A Board-approved Communication Policy is in place. |

Complied with |

|||||||||||||||||

|

(e) Reviewed the adequacy and the integrity of the Bank’s internal control systems and management information system. |

The Board reviews the adequacy and the integrity of the Bank’s internal control system by way of internal audit reports submitted to the Board through the Audit Committee on a monthly basis, which is also assured by the External Auditor. |

Complied with |

|||||||||||||||||

|

The Board Audit Committee (BAC) and the Board have reviewed the adequacy and the integrity of the Bank’s Management Information System. |

Complied with |

||||||||||||||||||

|

(f) Identified and designated Key Management Personnel, as defined in the Central Bank Guidelines. |

Based on Corporate Governance Direction issued by the Central Bank of Sri Lanka (CBSL), the Board has designated Key Management Personnel (KMP) of the Bank. |

Complied with |

|||||||||||||||||

|

(g) Defined the areas of authority and key responsibilities for the Board of Directors themselves and for the Key Management Personnel. |

Areas of authority and key responsibilities of the KMPs are included in their Job Descriptions (JDs). Areas of authority and key responsibilities of the Board of Directors (BOD) are defined in the Articles of Association. |

Complied with |

|||||||||||||||||

|

(h) Ensure that there is appropriate oversight of the affairs of the Bank by Key Management Personnel that is consistent with Board policy. |

The Board has exercised appropriate oversight of the affairs of the Bank by KMPs through the Chief Executive Officer (CEO) and when the need arises they are called upon by the Board to explain matters relating to their areas. |

Complied with |

|||||||||||||||||

|

(i) Periodically assess the effectiveness of the Board of Directors own governance policies including – |

|||||||||||||||||||

|

(a) The selection, nomination and election of Directors and Key Management Personnel. |

A transparent procedure for selecting and appointing new Directors upon the recommendation of the Board Selection and Nominations Committee and a Policy of selection, appointment and remuneration of the KMPs are in place. |

Complied with |

|||||||||||||||||

|

(b) The management of conflicts of interests. |

Directors’ interests are disclosed to the Board and Directors who have a particular interest in a matter that is being discussed abstained from voting in such a situation and he/she is not counted for the quorum. |

Complied with |

|||||||||||||||||

|

(c) The determination of weaknesses and implementation of changes where necessary. |

Determination of weaknesses of BODs has been identified through the self-evaluation process for 2022. |

Complied with |

|||||||||||||||||

|

(j) Ensure that the Bank has a succession plan for Key Management Personnel. |

The Bank has developed a succession plan and one to one succession plan for certain KMPs is available in the Bank. |

Complied with |

|||||||||||||||||

|

(k) Ensure that the Board has scheduled regular meetings with the Key Management Personnel to review policies, establish communication lines and monitor progress towards corporate objectives. |

The Board meets the KMPs to review policies and monitor progress towards corporate objectives at performance review meetings. When the need arises they are called upon by the Board to explain matters relating to their areas. |

Complied with |

|||||||||||||||||

|

(l) Understand the regulatory environment and that the Bank maintains a relationship with regulators. |

All the new regulations and directions issued by regulators and non-compliances are reported to the BOD by the Compliance Officer for their understanding of the regulatory environment. Awareness programmes are conducted on an ongoing basis. |

Complied with |

|||||||||||||||||

|

(m) Process in place for hiring and oversight of External Auditors. |

The Board selects External Auditors through the BAC, which holds responsibility for overseeing their activities. |

Complied with |

|||||||||||||||||

|

3 (1) (ii) |

The Board has appointed the Chairman / |

Appointment of the Chairperson and the CEO is done by the Board and functions are defined as per Direction No. 3 (5). |

Complied with |

||||||||||||||||

|

3 (1) (iii) |

The Board has met regularly and held Board meetings at least twelve times a year at approximately monthly intervals. |

20 meetings were held during the year. |

Complied with |

||||||||||||||||

|

3 (1) (iv) |

The Board has a procedure in place to enable all Directors to include matters and proposals in the agenda for regular Board meetings where such matters and proposals relate to the promotion of business and the management of risks of the Bank. |

A Board-approved procedure is in place allowing all Directors to include matters and proposals in the agenda for regular Board meetings. |

Complied with |

||||||||||||||||

|

3 (1) (v) |

The Board has given notice of at least seven days for a regular Board meeting to provide all Directors an opportunity to attend. And for all other Board meetings, notice has been given. |

Directors are notified of Board meetings more than seven days in advance. |

Complied with |

||||||||||||||||

|

3 (1) (vi) |

The Board has taken required action on Directors who have not attended at least two-third of the meetings in the period of 12 months immediately preceding or has not attended the immediately preceding three consecutive meetings held. Participation at the Directors’ meetings through an alternate Director, however, is acceptable as attendance. |

Such a situation did not arise during the year. |

Complied with |

||||||||||||||||

|

3 (1) (vii) |

The Board has appointed a Company Secretary who satisfies the provisions of Section 43 of the Banking Act No. 30 of 1988, and whose primary responsibilities shall be to handle the secretariat services to the Board and shareholder meetings and carry out other functions specified in the statutes and other regulations. |

The Company Secretary is an Attorney-at-Law who satisfies the provisions of Section 43 of the Banking Act No. 30 of 1988. |

Complied with |

||||||||||||||||

|

3 (1) (viii) |

All Directors are to have access to advice and services of the Company Secretary. |

All the Directors are free to access the Company Secretary for her advice and services. |

Complied with |

||||||||||||||||

|

3 (1) (ix) |

The Company Secretary maintains the minutes of Board meetings and there is a process for the Directors to inspect such minutes. |

The minutes of Board meetings are maintained by the Company Secretary; and during each Board meeting the Board of Directors approves the minutes of the previous Board meeting. |

Complied with |

||||||||||||||||

|

3 (1) (x) |

The minutes of a Board meeting contain or refer to the following:

|

Minutes of the Board meetings contain all the necessary information required under the direction. |

Complied with |

||||||||||||||||

|

3 (1) (xi) |

There are procedures agreed by the Board to enable Directors, upon reasonable request, to seek independent professional advice in appropriate circumstances, at the Bank’s expense. |

A Board-approved procedure is in place to seek independent professional advice when necessary, with the cost borne by the Bank. |

Complied with |

||||||||||||||||

|

3 (1) (xii) |

There is a procedure to determine, report, resolve and to take appropriate action relating to Directors avoiding conflicts of interests, or the appearance of conflicts of interest. A Director has abstained from voting on any Board resolution in relation to which he/she or any of his/her close relation or a concern, in which a Director has substantial interest, is interested and he/she shall not be in the quorum for the relevant agenda item at the Board meeting. |

There is a provision in the Related Party Transactions Policy to determine, report, resolve and to take appropriate actions relating to Directors to avoid conflicts of interest, or the appearance of conflicts of interest. |

Complied with |

||||||||||||||||

|

3 (1) (xiii) |

The Board has a formal schedule of matters specifically reserved to it for decision to identify the direction and control of the Bank is firmly under its authority. |

A formal schedule of matters specifically reserved for the Board is in place. |

Complied with |

||||||||||||||||

|

3 (1) (xiv) |

The Board has forthwith informed the Director of Bank Supervision of the situation of the Bank prior to taking any decision or action, if it considers that the procedures to identify when the Bank is, or is likely to be, unable to meet its obligations or is about to become insolvent or is about to suspend payments due to depositors and other creditors. |

This situation did not arise during the year. |

Complied with |

||||||||||||||||

|

3 (1) (xv) |

The Board shall ensure that the Bank is capitalised at levels as required by the Monetary Board. |

The Bank was fully compliant with the Capital Adequacy Requirements during the year. |

Complied with |

||||||||||||||||

|

3 (1) (xvi) |

The Board shall publish, in the Bank’s Annual Report, an Annual Corporate Governance Report setting out the compliance with Direction No. 3 of these directions. |

This report serves this purpose. |

Complied with |

||||||||||||||||

|

3 (1) (xvii) |

The Board adopts a scheme of self-assessment to be undertaken by each Director annually, and maintains records of such assessments. |

The Board has a scheme of self-assessment of Directors and the Company Secretary maintains records of such evaluations. |

Complied with |

||||||||||||||||

|

3 (2) |

The Board’s Composition |

||||||||||||||||||

|

3 (2) (i) |

The Board comprises not less than 7 and not more than 13 Directors. |

The Board comprised of thirteen Directors as at 31 December 2022. |

Complied with |

||||||||||||||||

|

3 (2) (ii) |

The total period of service of a Director other than a Director who holds the position of CEO, does not exceed nine years. |

Former Chairman retired after completion of nine years of service on the Board during the year 2022. |

Complied with |

||||||||||||||||

|

3 (2) (iii) |

The number of Executive Directors, including the CEO does not exceed one-third of the number of Directors of the Board. |

The Board comprises solely of Non-Executive Directors; the CEO is not a Board member. |

Complied with |

||||||||||||||||

|

3 (2) (iv) |

The Board has at least three independent Non-Executive Directors or one-third of the total number of Directors, whichever is higher. |

The Board comprises of five Independent Non-Executive Directors. |

Complied with |

||||||||||||||||

|

3 (2) (v) |

In the event an Alternate Director was appointed to represent an Independent Director, the person so appointed meets the criteria that apply to the Independent Director. |

This situation did not arise during the financial year 2022. |

Complied with |

||||||||||||||||

|

3 (2) (vi) |

The Bank has a process for appointing Independent Directors. |

A procedure is in place for appointing Independent Directors by the Board upon the recommendation of the Board Selection and Nominations Committee. |

Complied with |

||||||||||||||||

|

3 (2) (vii) |

The stipulated quorum of the Bank includes more than 50% of the Directors and out of this quorum more than 50% should include Non-Executive Directors. |

Every meeting during the year was consistent with the required quorum and composition. |

Complied with |

||||||||||||||||

|

3 (2) (viii) |

The Bank discloses the composition of the Board, by category of Directors, including the names of the Chairman, Executive Directors, Non-Executive Directors and Independent Non-Executive Directors in the Annual Corporate Governance Report. |

The composition of the Board has been disclosed under “Board of Directors” on pages 28 to 31 of this Annual Report. |

Complied with |

||||||||||||||||

|

3 (2) (ix) |

There shall be procedure for the appointment of new Directors to the Board. |

A procedure for appointing new Directors with the recommendation of the Board Selection and Nomination Committee is in place. |

Complied with |

||||||||||||||||

|

3 (2) (x) |

All Directors appointed to fill a casual vacancy are subject to election by shareholders at the first general meeting after their appointment. |

Appointment of Directors is done according to the Bank’s Articles of Association. |

Complied with |

||||||||||||||||

|

3 (2) (xi) |

If a Director resigns or is removed from office, the Board – (a) announce the Director’s resignation or removal and the reasons for such removal or resignation including but not limited to information relating to the relevant Director’s disagreement with the Bank, if any; and (b) Issue a statement confirming whether or not there are any matters that need to be brought to the attention of shareholders. |

Directors’ resignation/removal and the reason for such resignations are duly informed to the CBSL and Colombo Stock Exchange. |

Complied with |

||||||||||||||||

|

3 (2) (xii) |

There is a process to identify whether a Director or an employee of a Bank is appointed, elected or nominated as a Director of another Bank. |

Directors provide annual declarations regarding their employment or directorships in other organisations; None of the present Directors of the Bank acts as Director of another Bank. The Letter of Appointment and the Code of Conduct issued to the employees explicitly prevent employees from accepting any directorship of other banks without the prior permission from the Bank. |

Complied with |

||||||||||||||||

|

3 (3) |

Criteria to assess the fitness and propriety of Directors |

||||||||||||||||||

|

3 (3) (i) |

The age of a person who serves as Director does not exceed 70 years. |

Declarations given by Directors at the time of appointment indicate the date of birth. The age is monitored accordingly. |

Complied with |

||||||||||||||||

|

3 (3) (ii) |

No person shall hold office as a Director of more than 20 companies/entities/institutions inclusive of subsidiaries or associate companies of the Bank. |

As per the declaration made by Directors, none of the Directors is holding Directorship in more than 20 companies. |

Complied with |

||||||||||||||||

|

3 (4) |

Management functions delegated by the Board |

||||||||||||||||||

|

3 (4) (i) |

The delegation arrangements have been approved by the Board. |

The Board is empowered by the Articles of Association to delegate its powers to the CEO upon such terms and conditions and with such restrictions as the Board may think fit. |

Complied with |

||||||||||||||||

|

3 (4) (ii) |

The Board has taken responsibility for the matters in 3 (1) (i) even in the instances such actions are delegated. |

The Board has delegated its authority to KMPs through the CEO subject to final responsibility being retained with them. |

Complied with |

||||||||||||||||

|

3 (4) (iii) |

The Board reviews the delegation processes in place on a periodic basis to ensure that they remain relevant to the needs of the Bank. |

The delegated powers are reviewed periodically by the Board to ensure that they remain relevant to the needs of the Bank. |

Complied with |

||||||||||||||||

|

3 (5) |

The Chairman and CEO |

||||||||||||||||||

|

3 (5) (i) |

The roles of Chairman and CEO are separate and not performed by the same individual. |

Roles of Chairperson and CEO are held by two different individuals that carry out different functions. |

Complied with |

||||||||||||||||

|

3 (5) (ii) |

The Chairman is a Non-Executive Director. In the case where the Chairman is not an Independent Director, the Board designates an Independent Director as the Senior Director with suitably documented terms of reference. The designation of the Senior Director is disclosed in the Bank’s Annual Report. |

The Chairperson is a Non-Executive, Independent Director. This is disclosed under the “Annual Report of the Board of Directors on the Affairs of the Company” and “ Board of Directors”. |

Complied with |

||||||||||||||||

|

3 (5) (iii) |

The Board has a process to identify and disclose in its Corporate Governance Report, which shall be a part of its Annual Report, relationship, if any, between the Chairman and the CEO and Board members and the nature of any relationships including among members of the Board. |

There is a process to obtain an annual declaration from each Director about relationships, if any, between the Chairperson and the CEO and Board members and its nature. However, there were no relationship during the year 2022. |

Complied with |

||||||||||||||||

|

3 (5) (iv) |

The Board has a self-evaluation process where the Chairman – (a) Provides leadership to the Board; (b) Ensures that the Board works effectively and discharges its responsibilities; and (c) Ensures that all key and appropriate issues are discussed by the Board in a timely manner. |

A scheme of self-assessment process for the BOD is in place. |

Complied with |

||||||||||||||||

|

3 (5) (v) |

A formal agenda approved by the Chairman is circulated by the Company Secretary. |

The Agenda for each Board meeting is prepared by the Company Secretary, which is approved by the Chairperson. |

Complied with |

||||||||||||||||

|

3 (5) (vi) |

The Chairman ensures, through timely submission that all Directors are properly briefed on issues arising at Board meetings. |

The Chairperson ensures that the Directors receive adequate information in a timely manner and Directors are properly briefed on issues arising at the Board meeting. The minutes of the previous month’s meetings are distributed to the Board members in advance and tabled at the next Board meeting for approval. |

Complied with |

||||||||||||||||

|

3 (5) (vii) |

The Board has a self-evaluation process that encourages all Directors to make a full and active contribution to the Board’s affairs and the Chairman takes the lead to act in the best interest of the Bank. |

A scheme of self-assessment process for the BOD is in place which covers the requirement. |

Complied with |

||||||||||||||||

|

3 (5) (viii) |

The Board has a self-evaluation process that assesses the contribution of Non-Executive Directors. |

Assessment process covers the contribution of Non-Executive Directors as well. All the Directors are Non-Executive. |

Complied with |

||||||||||||||||

|

3 (5) (ix) |

The Chairman shall not engage in activities involving direct supervision of Key Management Personnel or any other executive duties whatsoever. |

The Chairperson is a Non-Executive Director and has not engaged in any activities involving direct supervision of KMPs or any other executive duties during the financial year 2022. |

Complied with |

||||||||||||||||

|

3 (5) (x) |

There is a process to maintain effective communication with shareholders and that the views of shareholders are communicated to the Board. |

AGM of the Bank is the main platform through which the Board maintains effective communication with shareholders and further, the communication policy of the Bank is evidence that there is a process in this regard. |

Complied with |

||||||||||||||||

|

3 (5) (xi) |

The CEO functions as the apex executive-in- charge of the day-to-day management of the Bank’s operations and business. |

The CEO functions as the apex executive-in charge of the day-to-day management of the Bank’s operations and business. |

Complied with |

||||||||||||||||

|

3 (6) Board-appointed Committees |

|||||||||||||||||||

|

3 (6) (i) |

The Bank has established at least four Board committees as set out in Direction 3 (6) (ii), 3 (6)(iii), 3 (6) (iv), and 3 (6) (v) of these Directions. The Committee reports are addressed directly to the Board. The Board presents in its Annual Report, a report on each committee on its duties, roles, and performance. |

Following committees have been established and they directly report to the Board and minutes of the same are discussed and ratified at the main Board meeting: (1) Board Audit Committee (BAC) (2) Board Human Resources and Remuneration Committee (BHRRC) (3) Board Selection and Nomination Committee (BSNC) (4) Board Integrated Risk Management Committee (BIRMC) (5) Board Credit Committee (BCC) (6) Board Related Party Transactions Review Committee (BRPTRC) (7) Board Strategic Planning Committee (8) Board Co-operative, Rural Enterprise and Livelihood Development Committee (9) Board IT Steering Committee (10) Board Sub Committee on Sustainability (11) Board Procurement and Assets Disposal Committee This is disclosed under the “Annual Report of the Board of Directors”. |

Complied with |

||||||||||||||||

|

3 (6) (ii) |

Board Audit Committee |

||||||||||||||||||

|

(a) The Chairman of the Committee is an Independent Non-Executive Director and possesses qualifications and related experience. |

The Chairman is an Independent Non-Executive Director who is qualified Chartered Accountant. |

Complied with |

|||||||||||||||||

|

(b) All members of the Committee are Non- Executive Directors. |

All members are Non-Executive Directors. |

Complied with |

|||||||||||||||||

|

(c) The Committee has made recommendations on matters in connection with – |

The Committee makes recommendations regarding those matters. |

Complied with |

|||||||||||||||||

|

(i) The appointment of the External Auditors for audit services to be provided in compliance with the relevant statutes; (ii) The implementation of the Central Bank guidelines issued to Auditors from time to time; (iii) The application of the relevant accounting standards; and (iv) The service period, audit fee and any resignation or dismissal of the Auditors; provided that the engagement of the Audit partner shall not exceed five years, and that the particular Audit partner is not re-engaged for the audit before the expiry of three years from the date of the completion of the previous term. |

|||||||||||||||||||

|

(d) The Committee has obtained representations from the External Auditor on their independence, and that the audit is carried out in accordance with SLAuS. |

External Auditors are independent since they report directly to the BAC. The Report on the Financial Statements of the Bank for the year 2022 indicates that the audit is carried out in accordance with SLAuS. |

Complied with |

|||||||||||||||||

|

(e) The Committee has implemented a policy on the engagement of an External Auditor to provide non-audit services in accordance with relevant regulations. |

The Committee has implemented a policy in this regard. |

Complied with |

|||||||||||||||||

|

(f) The Committee has discussed and finalised the nature and scope of the audit, with the External Auditors in accordance with SLAuS before the audit commences. |

The Committee has discussed and finalised the Audit Plan 2022, nature and scope of the audit and deliverables, with the External Auditors in accordance with SLAuS before the audit commences. |

Complied with |

|||||||||||||||||

|

(g) The Committee has a process to review the financial information of the Bank, in order to monitor the integrity of the Financial Statements of the Bank, its annual report, accounts, and quarterly reports prepared for disclosure, and a process in place to receive from the CFO the following: (i) Major judgemental areas; (ii) Any changes in accounting policies and practices; (iii) The going concern assumption; and (iv) The compliance with relevant accounting standards and other legal requirements; and (v) In respect of the Annual Financial Statements the significant adjustments arising from the audit. |

The BAC reviews the financial information of the Bank, in order to monitor the integrity of the Financial Statements of the Bank, when the Annual Financial Statements and other accounts are submitted to the BAC by the CFO. |

Complied with |

|||||||||||||||||

|

(h) The Committee has met the External Auditors relating to any issue in the absence of the Executive Management with relation to the audit. |

The Committee has met the External Auditors in the absence of the Executive Management during the year. |

Complied with |

|||||||||||||||||

|

(i) The Committee has reviewed the External Auditors’ Management Letter and the Management’s response thereto. |

The BAC reviews the External Auditors’ Management Letter and Management, response at the meeting. |

Complied with |

|||||||||||||||||

|

(j) The Committee shall take the following steps with regard to the internal audit function of the Bank; |

|||||||||||||||||||

|

(i) Review the adequacy of the scope, functions, and resources of the Internal Audit Department, and satisfy itself that the Department has the necessary authority to carry out its work; |

The Committee reviews the adequacy of the scope, functions, and resources of the Internal Audit Department. |

Complied with |

|||||||||||||||||

|

(ii) Review the internal audit programme and results of the internal audit process and, where necessary, ensure that appropriate actions are taken on the recommendations of the Internal Audit Department; |

The Committee reviewed the internal audit programmes, and progress of internal audit function for the year 2022 and was discussed at BAC. |

Complied with |

|||||||||||||||||

|

(iii) Review any appraisal or assessment of the performance of the Head and Senior staff members of the Internal Audit Department; |

The BAC has evaluated the performance of the Head of Internal Audit and senior staff members for the year 2022. |

Complied with |

|||||||||||||||||

|

(iv) Recommend any appointment or termination of the head, senior staff members, and outsourced service providers to the internal audit function; |

No any appointment or termination of head, senior staff in the year 2022. |

Complied with |

|||||||||||||||||

|

(v) The Committee is appraised of resignations of senior staff members of the Internal Audit Department including the Chief Internal Auditor and any outsourced service providers, and to provide an opportunity to the resigning senior staff members and outsourced service providers to submit reasons for resigning; |

There were no outsourced service providers or resignations of senior staff members of the Internal Audit Department during the period. |

Complied with |

|||||||||||||||||

|

(vi) The internal audit function is independent of the activities it audits. |

Internal Audit Department is independent since they report directly to the BAC and is not involved in any operational activities of the Bank. Its functions are performed with impartial proficiency and due professional care. |

Complied with |

|||||||||||||||||

|

(k) The minutes to determine whether the Committee has considered major findings of internal investigations and Management’s responses thereto; |

The Committee has reviewed all the findings and advised the internal investigation officers for appropriate actions. |

Complied with |

|||||||||||||||||

|

(l) Ensure that whether the Committee has had at least two meetings with the External Auditors without the Executive Directors being present. |

There are no Executive Directors on the Board and the Committee met on two occasions with the External Auditors. |

Complied with |

|||||||||||||||||

|

(m) The Terms of Reference of the Committee to ensure that there is – (i) Explicit authority to investigate into any matter within its Terms of Reference; (ii) The resources which it needs to do so; (iii) Full access to information; and (iv) Authority to obtain external professional advice and to invite outsiders with relevant experience to attend, if necessary. |

The Board approved Terms of Reference (ToR) of the Committee addresses all those matters. |

Complied with |

|||||||||||||||||

|

(n) The Committee shall meet regularly, with due notice of issues to be discussed and shall record its conclusions in discharging its duties. |

During the year 2022, the BAC held 24 regular meetings and its minutes are maintained by the Company Secretary. |

Complied with |

|||||||||||||||||

|

(o) The Board has disclosed in the Annual Report, (i) Details of the activities of the Audit Committee; (ii) The number of Audit Committee meetings held in the year; and (iii) Details of attendance of each Individual Director at such meetings. |

This information is disclosed in the Annual Report under the following headings: “Report of the Board Audit Committee”. and (iii) “ Annual Report of the Board of Directors on the Affairs of the Company” |

Complied with |

|||||||||||||||||

|

(p) The secretary of the Committee is the Company Secretary or the Head of the internal audit function. |

The secretary of the Committee is the Chief Internal Auditor. |

Complied with |

|||||||||||||||||

|

(q) The Committee shall review arrangements by which employees of the Bank may, in confidence, raise concerns about possible improprieties in financial reporting, internal control or other matters. Accordingly, the Committee shall ensure that proper arrangements are in place for the fair and independent investigation of such matters and for appropriate follow-up action and to act as the key representative body for overseeing the Bank’s relations with the External Auditors. |

This requirement has been documented in the |

Complied with |

|||||||||||||||||

|

3 (6) (iii) |

The following rules apply in relation to the Human Resources and Remuneration Committee: |

||||||||||||||||||

|

(a) The Committee has implemented a policy to determine the remuneration (salaries, allowances, and other financial payments) relating to Directors, CEO and Key Management Personnel of the Bank by review of the “Terms of Reference” and minutes. |

The BHRRC has implemented a policy to determine the remuneration of Directors. The Committee has implemented a policy to determine the remuneration relating to CEO and KMPs of the Bank. |

Complied with |

|||||||||||||||||

|

(b) The goals and targets for the Directors, CEO and the Key Management Personnel are documented. |

Goals and targets of CEO and KMPs are reviewed by the BHRRC. No Executive Directors are available on the Board. |

Complied with |

|||||||||||||||||

|

(c) The Committee has considered evaluations of the performance of the CEO and Key Management Personnel against the set targets and goals periodically and determines the basis for revising remuneration, benefits, and other payments of performance-based incentives. |

The Bank has a process to review and evaluate the performance of CEO and KMPs by the BHRRC/BAC or BIRMC. The performance evaluations of the CEO and Key Management Personnel have been completed against the set targets and the goals for 2021 and the same are in progress in 2022. |

Complied with |

|||||||||||||||||

|

(d) The CEO shall be present at all meetings of the Committee, except when matters relating to the CEO are being discussed. |

The CEO is present at all meetings other than when matters relating to the CEO are discussed. |

Complied with |

|||||||||||||||||

|

3 (6) (iv) |

The following rules apply in relation to the Nomination Committee: |

||||||||||||||||||

|

(a) The Committee has implemented a procedure to select/appoint new Directors, CEO, and Key Management Personnel. |

The Board has a policy and procedure for the selection and appointment of the Directors, CEO and KMPs |

Complied with |

|||||||||||||||||

|

(b) The Committee has considered and recommended (or not recommended) reelection of current Directors. |

Duly recommended. |

Complied with |

|||||||||||||||||

|

(c) The Committee has set the criteria such as qualifications, experience, and key attributes required for eligibility to be considered for appointment or promotion to the post of CEO, and the Key Management Personnel, by review of job descriptions. |

Criteria such as qualifications, experience, and key attributes required for eligibility for appointment or promotion to the post of CEO are submitted at the Selection and Nomination Committee. Criteria for KMPs are included in their job descriptions approved by the BHRR committee. These job descriptions are submitted at the Nomination Committee for their review. |

Complied with |

|||||||||||||||||

|

(d) The Committee has obtained from the Directors, CEO, and Key Management Personnel signed declarations that they are fit and proper persons to hold office as specified in the criteria given in Direction No. 3 (3) and as set out in the Statutes. |

Signed declarations are obtained from Directors, CEO, and KMPs that they are fit and proper persons to hold the office. |

Complied with |

|||||||||||||||||

|

(e) The Committee has considered a formal succession plan for the retiring Directors and Key Management Personnel. |

The Committee has developed a succession plan and procedure for appointing Independent Non-Executive Directors in place of retiring Directors of the Bank. The Bank has a succession plan for KMPs. It is under review to meet the emerging requirements of the Bank. |

Complied with |

|||||||||||||||||

|

(f) The Committee shall be chaired by an Independent Director and preferably be constituted with a majority of Independent Directors. The CEO may be present at meetings by invitation. |

The Committee is chaired by an Independent Director, and the majority of the members are also Independent Directors. The CEO participates only on invitation. |

Complied with |

|||||||||||||||||

|

3 (6) (v) |

The following rules apply in relation to the Board Integrated Risk Management Committee (BIRMC): |

||||||||||||||||||

|

(a) The Committee shall consist of at least three Non-Executive Directors, CEO, and Key Management Personnel supervising broad risk categories, i.e. credit, market, liquidity, operational, and strategic risks, and work within the framework of the authority and responsibility assigned to the Committee. |

At present the BIRMC consists of five Non-Executive Directors. The Committee includes CEO and KMPs supervising broad risk categories, i.e. credit, market, liquidity, operational, and strategic risks as members of the Committee. |

Complied with |

|||||||||||||||||

|

(b) The Committee has a process to assess all risks, i.e. credit, market, liquidity, operational, and strategic risks to the Bank on a monthly basis through appropriate risk indicators and management information. In the case of subsidiary companies and associate companies, risk management shall be done, both on a Bank basis and Group basis. |

Credit, market, operational, and strategic risks are evaluated on a monthly basis by the Risk Management Department and minutes are submitted to the BIRMC on a monthly/quarterly basis. |

||||||||||||||||||

|

(c) The Committee has reviewed specific quantitative and qualitative risk limits for all management level Committees such as the Credit Committee and the Asset and Liability Committee, and report any risk indicators periodically. |

The Committee will initiate action to review effectiveness of management level committees moving forward. |

||||||||||||||||||

|

(d) The Committee has reviewed and considered all risk indicators which have gone beyond the specified quantitative and qualitative risk limits. |

The BIRMC reviews risk indicators which have exceeded the defined limits. |

Complied with |

|||||||||||||||||

|

(e) The Committee has met at least quarterly. |

The Committee met eight times during 2022. |

||||||||||||||||||

|

(f) The Committee has reviewed and adopted a formal documented disciplinary action procedure with regard to officers responsible for failure to identify specific risks. |

Disciplinary actions to be taken against officers responsible for failure to identify specific risk is discussed at the Committee and it is incorporated into the disciplinary procedure manual. |

Complied with |

|||||||||||||||||

|

(g) The Committee submits a risk assessment report within a week of each meeting to the Board seeking the Board’s views, concurrence and/or specific directions. |

As a practice minutes of EIRMC are submitted to next board meeting. This process will be further strengthened to submit a report on each meeting with in a week to the Board. |

Complied with |

|||||||||||||||||

|

(h) The Committee has established a compliance function to assess the Bank’s compliance with laws, regulations, regulatory guidelines, internal controls, and approved policies on all areas of business operations and that there is a dedicated Compliance Officer selected from Key Management Personnel to carry out the compliance function and report to the Committee periodically. |

Compliance function is in place to ensure that the Bank complies with all relevant regulations, rules, and guidelines. A dedicated senior officer has been appointed by the Bank in this regard who has designated as a KMP. The Compliance Officer submits a monthly compliance report to the Board and Related Party Transactions Report on a monthly basis to the main Board. |

Complied with |

|||||||||||||||||

|

3 (7) |

Related Party Transactions |

||||||||||||||||||

|

3 (7) (i) |

There is an established and documented process by the Board to avoid any conflicts of interest that may arise from any transaction of the Bank with any person, and particularly with the following categories of persons who shall be considered as “related parties” for the purposes of this Direction: (a) Any of the Bank’s subsidiary companies; (b) Any of the Bank’s associate companies; (c) Any of the Directors of the Bank; (d) Any of the Bank’s Key Management Personnel; (e) A close relation of any of the Bank’s Directors or Key Management Personnel; (f) A shareholder owning a material interest in the Bank; (g) A concern in which any of the Bank’s Directors or a close relation of any of the Bank’s Directors or any of its material shareholders has a substantial interest. |

There is a Board approved “Related Party Transactions Policy” which defines guidelines on related parties and avoiding any conflicts of interest with said parties that may arise from such transactions of the Bank. Transactions with related parties are done strictly according to the Board approved Related Party Transactions Policy and are reported to the Board on a monthly basis. Further, the Related Party Transactions Review Committee (RPTRC) is a subcommittee of the Board and is responsible for making decisions over related party transactions other than day-to-day normal business activities. |

Complied with |

||||||||||||||||

|

3 (7) (ii) |

There is a process to identify and report the following types of transactions as transactions with related parties that are covered by this direction. (a) The grant of any type of accommodation, as defined in the Monetary Board’s directions on maximum amount of accommodation. (b) The creation of any liabilities of the Bank in the form of deposits, borrowings, and investments. (c) The provision of any services of a financial or non-financial nature provided to the Bank or received from the Bank. (d) The creation or maintenance of reporting lines and information flows between the Bank and any related parties which may lead to the sharing of potentially proprietary, confidential, or otherwise sensitive information that may give benefits to such related parties, |

There is a Board approved “Related Party Transactions Policy” which defines guidelines on related parties and avoiding any conflicts of interests with said parties that may arise from such transactions of the Bank. The Bank has an established process of reporting related party transactions with regard to related entities to the Board of Directors on a monthly basis. |

Complied with |

||||||||||||||||

|

3 (7) (iii) |

The Board has a process to ensure that the Bank does not engage in transactions with related parties as defined in Direction 3 (7) (i), in a manner that would grant such parties “more favourable treatment” than that accorded to other constituents of the Bank carrying on the same business. (a) Granting of “total net accommodation” to related parties, exceeding a prudent percentage of the Bank’s regulatory capital, as determined by the Board. (b) Charging of a lower rate of interest than the Bank’s best lending rate or paying more than the Bank’s deposit rate for a comparable transaction with an unrelated comparable counter-party. (c) Providing of preferential treatment, such as favourable terms, covering trade losses and/or waiving fees/commissions, that extend beyond the terms granted in the normal course of business undertaken with unrelated parties; |

The Board approved “Related Party Transactions Policy” is in place. It defines related parties and types of related party transactions and the Bank does not engage in transactions with related parties as defined in Direction 3 (7) (i) above, in a manner that would grant such parties “more favourable treatment” than that accorded to other constituents of the Bank carrying on the same business. The Bank modified the system to enable the effective identification of related party transactions and to ensure that there are no favourable treatments offered to such related parties than that accorded to other constituents of the Bank carrying on the same business. |

|||||||||||||||||

|

(d) Providing services to or receiving services from a related party without an evaluation procedure; (e) Maintaining reporting lines and information flows that may lead to sharing potentially proprietary, confidential, or otherwise sensitive information with related parties, except as required for the performance of legitimate duties and functions. |

Monitoring is being carried out covering all the products of the Bank to ensure that the Bank does not offer “more favourable treatment” to related parties. However, this process needs to be strengthened, implementing a mechanism to get a “pop up” when the name or other identifying data of a related party is entered into systems of the Bank. |

Complied with |

|||||||||||||||||

|

3 (7) (iv) |

The Bank has a process for granting accommodation to any of its Directors and Key Management Personnel, and that such accommodation is sanctioned at a meeting of its Board of Directors, with not less than two-third of the number of Directors other than the Director concerned, voting in favour of such accommodation and that this accommodation be secured by such security as may from time to time be determined by the Monetary Board as well. |

This requirement is documented in the Board approved Related Party Transactions Policy. |

Complied with |

||||||||||||||||

|

3 (7) (v) |

(a) The Bank has a process, where any accommodation has been granted by a bank to a person or a close relation of a person or to any concern in which the person has a substantial interest, and such person is subsequently appointed as a Director of the Bank, that steps have been taken by the Bank to obtain the necessary security as may be approved for that purpose by the Monetary Board, within one year from the date of appointment of the person as a Director. |

No such matters were pending as at 31 December 2022. |

Complied with |

||||||||||||||||

|

(b) Where such security is not provided by the period as provided in Direction 3 (7) (v) (a) above, has the Bank taken steps to recover any amount due on account of any accommodation, together with interest, if any, within the period specified at the time of the grant of accommodation or at the expiry of a period of eighteen months from the date of appointment of such Director, whichever is earlier. |

No such matters are outstanding as at 31 December 2022. |

Complied with |

|||||||||||||||||

|

(c) There is a process to identify any Director who fails to comply with the above sub directions, be deemed to have vacated the office of Director and has the Bank disclose such fact to the public. |

Such a situation did not occur during 2022. |

Complied with |

|||||||||||||||||

|

(d) Process in place to ensure Clause 3 (7) (v) (c) does not apply to any Director who at the time of the grant of the accommodation was an employee of the Bank and the accommodation was granted under a scheme applicable to all employees of such Bank. |

Such a situation did not occur during 2022. |

Complied with |

|||||||||||||||||

|

3 (7) (vi) |

There is a process in place to identify when the Bank grants any accommodation or “more favourable treatment” relating to the waiver of fees and/or commissions to any employee or a close relation of such employee or to any concern in which the employee or close relation has a substantial interest other than on the basis of a scheme applicable to the employees of such Bank or when secured by security as may be approved by the Monetary Board in respect of accommodation granted as per Direction 3 (7) (v) above. |

No favourable treatment was given to the employees under any category other than staff benefit schemes approved by the Board of Directors. |

Complied with |

||||||||||||||||

|

3 (7) (vii) |

There is a process to obtain prior approval from the Monetary Board for any accommodation granted by the Bank under Direction 3 (7) (v) and 3 (7) (vi) above, nor any part of such accommodation, nor any interest due thereon been remitted without the prior approval of the Monetary Board and any remission without such approval is void and has no effect. |

Not applicable due to the reasons mentioned in 3 (7) (v) and 3 (7) (vi) above. |

Complied with |

||||||||||||||||

|

3 (8) |

Disclosures |

||||||||||||||||||

|

3 (8) (i) |

The Board ensures that the Board has disclosed: (a) Annual Audited Financial Statements prepared and published in accordance with the formats prescribed by the supervisory and regulatory authorities and applicable accounting standards, and that such statements published in the newspapers in an abridged form, in Sinhala, Tamil and English. (b) Quarterly Financial Statements are prepared and published in the newspapers in an abridged form, in Sinhala, Tamil and English. |

Annual Audited Financial Statements including the basis of preparation and presentation and statement of compliance is disclosed in the Annual Report 2022 and such Audited Financial Statements and quarterly Financial Statements have been published in the newspapers in an abridged form, in Sinhala, Tamil and English. |

Complied with |

||||||||||||||||

|

3 (8) (ii) |

The Board has made the following minimum disclosures in the Annual Report: (a) The statement to the effect that the Annual Audited Financial Statements have been prepared in line with applicable accounting standards and regulatory requirements, inclusive of specific disclosures. |

Specific disclosures are available on page 167 of this Annual Report under “Statement of Directors Responsibility for Financial Reporting”. |

Complied with |

||||||||||||||||

|

(b) The report by the Board on the Bank’s internal control mechanism that confirms that the financial reporting system has been designed to provide reasonable assurance regarding the reliability of financial reporting, and that the preparation of Financial Statements for external purposes has been done in accordance with relevant accounting principles and regulatory requirements. |

Specific disclosures are available on pages 162 and 163 of this Annual Report under “Directors’ Statement on Internal Control over Financial Reporting”. |

Complied with |

|||||||||||||||||

|

(c) The Board has obtained the assurance report issued by the Auditors under “Sri Lanka Standards on Assurance Engagements SLSAE – 3050 – Assurance reports for banks on Directors Statement on Internal Control” referred to in Direction 3 (8) (ii) (b) above. |

The Board has obtained the Assurance Report issued by the Auditors under “Sri Lanka Standard on Assurance Engagements SLSAE 3050 – Assurance Reports for Banks on Directors’ Statement on Internal Control” and included on page 164 of this Annual Report. |

Complied with |

|||||||||||||||||

|

(d) Details of Directors, including names, qualifications, age, experience fulfilling the requirements of the guideline, fitness and propriety, transactions with the Bank, and the total of fees/remuneration paid by the Bank. |

Details on the same are disclosed under heading “Board of Directors”. Fees and transactions with the Bank has been disclosed in this report under Direction 3 (8) (ii) (f). |

Complied with |

|||||||||||||||||

|

(e) Total net accommodation as defined in Direction 3 (7) (iii) granted to each category of related parties. The net accommodation granted to each category of related parties shall also be disclosed as a percentage of the Bank’s regulatory capital. |

Disclosures of accommodation outstanding as of balance sheet date to related parties are made under Notes to the Financial Statements in the Annual Report. Net accommodations granted to each category of related parties and its percentage as a Bank capital is as follows:

Spouses and other family members of related parties – NIL |

Complied with |

|||||||||||||||||

|

(f) The aggregate values of remuneration paid by the Bank to its Key Management Personnel and Directors, and the aggregate values of the transactions of the Bank with its Key Management Personnel and Directors, set out by broad categories such as remuneration paid, accommodation granted and deposits or investments made in the Bank. |

Disclosure of remuneration paid by the Bank to its KMP and Directors and other transactions with KMPs and Directors are disclosed below.

|

Complied with |

|||||||||||||||||

|

(g) Board has confirmed in its Annual Corporate Governance Report that all the findings of the “Factual Findings Report” of Auditors issued under “Sri Lanka Related Services Practice Statement 4750” have been incorporated in the Annual Corporate Governance Report. |

The Board has confirmed in the Annual Corporate Governance Report that all the findings of the “Factual Findings Report” of Auditors issued under “Sri Lanka Related Services Practice Statement 4750” have been incorporated in Annual Corporate Governance Report. |

Complied with |

|||||||||||||||||

|

(h) A report setting out details of the compliance with prudential requirements, regulations, laws, and internal controls and measures taken to rectify any material non-compliance. |

This aspect is covered by the “Board of Directors on the affairs of the Company” on pages 148 to 171 of this Annual Report. |

Complied with |

|||||||||||||||||

|

(i) A statement of the regulatory and supervisory concerns on lapses in the Bank’s risk management, or non-compliance with these directions that have been pointed out by the Director of Bank Supervision, if so directed by the Monetary Board to be disclosed to the public, together with the measures taken by the Bank to address such concerns. |

No such direction was issued by the Monetary Board during the year. |

Complied with |

|||||||||||||||||

COMPLIANCE WITH THE CODE OF BEST PRACTICE ON CORPORATE GOVERNANCE

| Corporate Governance Principle |

CA Sri Lanka Code Reference |

Description of the Requirement | SDB bank’s Extent of Compliance in 2022 |

| A. DIRECTORS | |||

| A.1. The Board | |||

| The Bank should be headed by a Board, which should direct, lead, and control the Bank | |||

|

All Directors of the Bank function in a Non-Executive capacity. The Board consists of professionals in the fields of Banking, Accounting, Rural Development, Management and Economics. All Directors possess the skills, experience and knowledge combined with a high sense of integrity and independent judgement. The Board gives leadership in setting the strategic direction and establishing a sound control framework for the successful functioning of the Bank. The Board’s composition reflects sound balance of independence and anchors shareholder commitment. |

|||

|

1. Board meetings |

A.1.1 |

The Board should meet regularly. At least once a quarter. |

The Board meets regularly on a monthly basis. During the year the Board met 20 times. |

|

2. Board responsibilities |

A.1.2 |

Board should provide an entrepreneurial leadership within a framework of prudent and effective controls. |

The Board is responsible to the shareholders for creating and delivering sustainable shareholder value through the management of business. The Board has provided strategic direction in vision statement, mission statement and the Annual budget. |

|

3. Compliance with laws and access to independent professional advice |

A.1.3 |

The Board collectively and Directors individually must act in accordance with rules and regulations. |

The Board collectively as well the Directors individually, recognise their duties to comply with laws of the country which are applicable to the Bank. A procedure has been put in place for Directors to seek independent professional advice, in furtherance of their duties, at the Bank’s expense. This will be coordinated through the Board Secretary, as and when it is requested. |

|

4. Board secretary |

A.1.4 |

All Directors should have access to the advice and services of secretary. |

All Directors have access to the Board Secretary. Further, she provides the Board with support and advice relating to Corporate Governance matters, Board procedures and applicable rules and regulations. |

|

5. Independent judgement |

A.1.5 |

All Directors should bring an independent judgement to bear on issues of strategy. |

Directors are responsible for bringing independent and objective judgement, and scrutinising the decisions taken by the Corporate Management led by the CEO, on issues of strategy, performance, resource utilisation and business conduct. |

|

6. Dedication of adequate time and effort by the Board and Board Committees |

A.1.6 |

Every Director should dedicate adequate time and effort to matters of the Board and the Company. |

“The Chairman and members of the Board have dedicated adequate time for the fulfilment of their duties as Directors of the Bank. In addition to attending Board meetings, they have attended Subcommittee meetings and also have made decisions via circular resolution where necessary. Papers relating to the Board meetings are sent well in advance allowing sufficient time for preparation.” |

|

7. Training for new Directors |

A.1.7 |

Every Director should get an appropriate training. |

The Board of Directors recognises the need for continuous training and expansion of knowledge and undertakes such professional development as they consider necessary in assisting them to carry out their duties as Directors. |

| A.2 Chairman and CEO | |||

| There should be a clear division of responsibilities between the Chairman and the Chief Executive Officer to ensure a balance of power and authority, in such a way that any individual has no unfettered powers of decisions. The roles of the Chairman and the Chief Executive Officer are functioning separately at SDB bank. The Chairman’s main responsibility is to lead, direct and manage the work of the Board to ensure that it operates effectively and fully discharges its legal and regulatory responsibilities. CEO is responsible for the day-to-day operations of the Bank. | |||

|

1. Division of responsibilities of the Chairman and the MD/CEO |

A.2.1 |

A decision to combine the posts of Chairman and the CEO in one person should be justified and highlighted in the Annual Report. |

The roles of the Chairperson and the Chief Executive Officer have been segregated, ensuring an appropriate balance of power. |

| A.3 Chairman’s role | |||

| The Chairman should lead and manage the Board, ensuring that it discharges its legal and regulatory responsibilities effectively and fully and preserves order and facilitates the effective discharge of the Board function. | |||

|

1. Role of the Chairman |

A.3.1 |

The Chairman should conduct Board proceedings in a proper manner and ensure an effective discharge of the Board functions. |

The Chairperson leads the Board ensuring effectiveness in all aspects of its role. The Chairperson of SDB bank is a Non-Executive Director, elected by the Board. The Chairperson’s role encompasses – Ensuring that the new Board members are given appropriate induction, covering terms of appointment, duties and responsibilities. |

| A.4 Financial acumen | |||

| The Board should ensure the availability within it of those with sufficient financial acumen and knowledge to offer guidance on matters of finance. The Board is equipped with members having sufficient financial acumen and knowledge. | |||

|

1. Availability of sufficient financial acumen and knowledge |

A.4.1 |

The Board should ensure the availability within it of those with sufficient financial acumen and knowledge to offer guidance on matters of finance. |

There is sufficient financial acumen on the Board, gained from leading large private and public enterprises coupled with academic and professional backgrounds. The details of their qualifications and experiences have been listed in the Annual Report under “Board of Directors”. |

| A.5 Board balance | |||

| It is preferable for the Board to have balance of Executive and Non-Executive Directors such that no individual or a small group of individuals can dominate the Board’s decision-taking. | |||

|

1. Presence of Non-Executive Directors |

A.5.1 |

The Board should include at least two Non- Executive Directors or a number equalling to 1/3 of all Directors whichever is higher and in the event of CEO and Chairman is same the majority should be consistent with Non-Executives. |

All Directors are Non-Executive Directors. The requirement as per the direction has been complied throughout 2022. |

|

2. Independent Directors |

A.5.2 |

Two or 1/3 of Non-Executive Directors out of all, should be Independent Directors. |

Board comprises five Independent, Non-Executive Directors. |

|

3. Criteria to evaluate Independence of Non-Executive Directors |

A.5.3 |

For a Director to be deemed as “Independent”, such Director should be independent from management and free of any business or other relationships that could materially interfere. |

Compliant with independence criteria. |

|

4. Signed declaration of independence by the Non-Executive Directors |

A.5.4 |

Each Non-Executive Director should submit a signed and dated declaration annually of his/her independence. |

A declaration of Independence is signed by all Non-Executive Directors. |

|

5. Determination of independence of the Directors by the Board |

A.5.5 |

The Board should make a determination annually as to the independence or Non-Independence of each Non-Executive Director. |

The Board has determined that the submission of declaration/s by the Non-Executive Directors, as to their independence, as fair representation and will continue to evaluate their submission annually. |

|

6. Appointment of alternate Director |

A.5.6 |

If an Alternate Director is appointed by a Non- Executive Director such Alternate Director should not be an Executive of the Bank. |

No Alternate Director was appointed during the year 2022. |

|

7. Senior Independent Directors |

A.5.7 |

In the event the Chairman and CEO is the same person, the Board should appoint one of the Independent Non-Executive Directors to be the “Senior Independent Director” and disclose this appointment in Annual Report. |

Roles of the Chairperson and the CEO are held by two different individuals that carry out different functions. |

|

8. Confidential discussion with the Senior Independent Director |

A.5.8 |

The Senior Independent Director should make himself available for confidential discussions with other Directors. |

The roles of the Chairperson and the CEO are segregated. |

|

9. Meeting of Non-Executive Directors |

A.5.9 |

The Chairman should hold meetings with the Non-Executive Directors only, without the Executive Directors being present, as necessary and at least once each year. |

All Directors are Non-Executive Directors and meet on a monthly basis. |

|

10. Recording of concerns in Board minutes |

A.5.10 |

Where Directors have concerns about the matters of the Company which cannot be unanimously resolved, they should ensure their concerns are recorded in the Board minutes. |

Concerns of Directors have been duly recorded in Board minutes. |

| A.6 Supply of information | |||

| Management should provide time bound information in a form and of quality appropriate to enable the Board to discharge its duties. | |||

|

1. Information to the Board by the Management |

A.6.1 |

Management has the responsibility to provide the information appropriately and timely to the Board. But information volunteered by Management is not always enough and Directors should make further inquiries where necessary. |

The Board was provided with timely and appropriate information by the Management by way of Board papers and proposals. The Board sought additional information as and when necessary. Members of the Corporate Management made presentations on issues of importance whenever clarification was sought by the Board. The Chairperson ensured that all Directors were briefed on issues arising at Board meetings. |

|

2. Adequate time for effective Board meetings |

A.6.2 |

The minutes, agenda and papers required for a Board meeting should ordinarily be provided to Directors at least seven days before. |

The Board papers were circulated to the Directors at least a week before the respective Board meetings by giving an adequate time for Directors to study the papers and prepare for a meaningful discussion at the meeting. |

| A.7 Appointments to the Board | |||

| There should be a formal and transparent procedure for the appointment of new Directors to the Board. | |||

|

1. Nomination Committee |

A.7.1 |

A Nomination Committee should be established to make recommendations to the Board on selection of New Directors. The Chairman and members of the Committee should be disclosed in the Annual Report. |

The Nomination Committee made recommendations to the Board on all new Board appointments. The Terms of Reference of the Committee was formally approved by the Board and Chairman and members are disclosed in the Annual Report under “Report of the Board Selection and Nomination Committee (BS & NC)”. |

|

2. Assessment of Board composition by the Nomination Committee |

A.7.2 |

The Nomination Committee or in the absence of Nomination Committee, the Board as a whole should annually assess Board composition. |