Management Discussion and Analysis

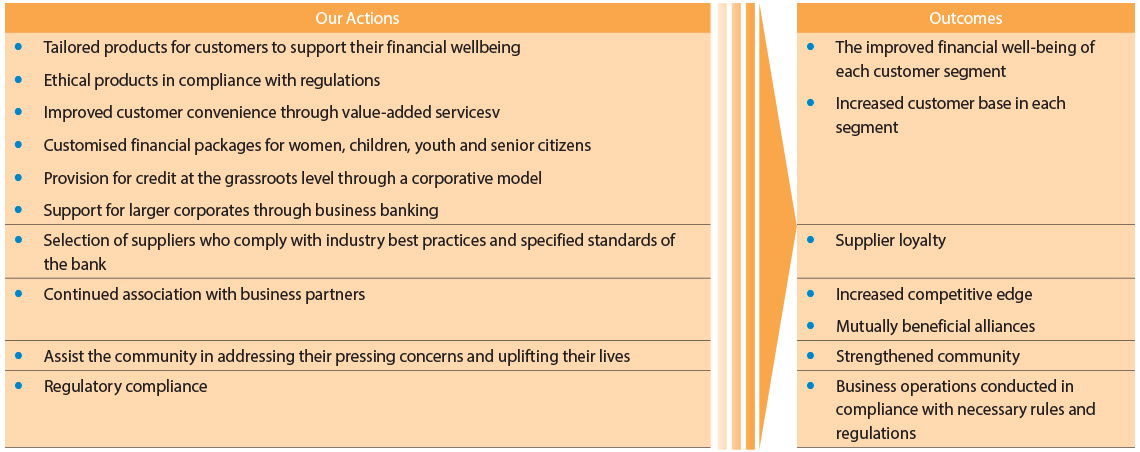

Social and Relationship Capital

Takeouts for the next FY

- Continue to develop products to cater to all customer segments and support their financial wellbeing

- Foster strategic business partnerships for long term value creation

- Continued strengthening of banking platform for secure transactions

During the year, despite a challenging external environment, we were steadfast in seeking the right skills and traits that could drive our strategy in the long term. We also continued to improve the existing talents of employees by providing them opportunities to enhance their capacities to perform their current job roles more effectively while strengthening their future career paths.

Customers

The trust that the customer place in us is crucial to our continued progress as a development bank that is focused on the financial inclusion of the progressive masses. Hence, we consistently make effort to understand the customer requirement thereby devising products to support their financial well-being. Amidst a volatile operating environment during the year, we remained well-positioned to navigate individuals and SMEs through financial assistance to support their livelihoods. By being consistently open to adopting strategies that enhance the customer experience, SDB bank has succeeded in establishing a robust presence among small and medium entrepreneurs over the years giving enhanced focus to women’s empowerment and digital inclusion.

How We Create Value for Customers

- A product portfolio that caters to customer requirements ensuring their financial wellbeing

- Ethical product development in adherence to all the necessary compliance requirements

- Customer convenience and accessibility through a widespread branch network, digital platform, improved customer service

- Secure platform for banking transactions ensuring customer privacy

At present, we cater to the following customer segments;

- SMEs: Micro, Small and Medium-sized enterprises

- Individual/retail Customers: General Savers, Minors, Women, Youth, Senior Citizens and Veterans

- Cooperatives: Small clusters of individuals collaborating with cooperative societies in grassroots communities

- Business Banking: Mid-scale businesses that do not fall under Micro or SME categories

Small & Medium Entrepreneurs (SMEs)

Sri Lanka's small and medium enterprises play an important role in the country's economic revival. With more than 75% of the enterprises under the SME banner, these enterprises represent the businesses at the grassroots level that has growth potential. Hence, our support to SMEs is aimed at uplifting these communities through facilitating guided financial assistance to raise their livelihoods and living standards.

We provide a range of loan products to suit the requirement of every social segment from young entrepreneurs to women and senior citizens who are engaged in the workforce. Active products in the SME segment include SME, Divi Saviya, Jawaya, Upahara and Uththamavi. The country’s prevailing situation remained a hindrance to expanding our loan portfolio during the year. However, the bank disbursed a total of LKR 17 Bn during the year. Credit lines were granted by CBSL and the Ministry of Finance in addition to the funds acquired from the Development Finance Corporation of USA. Our lending largely focused on financing agriculture, dairy farming, and women-based enterprises.

The loan portfolio grew by approximately 9,000 customers compared to the previous year with a total of 75,000 customers at the end of the financial year.

| SME LoC Loan Scheme | Women’s Programs at Branches | Introduced ‘Business Saver Account’ |

| A scheme funded by the Ministry of Finance and ADB aimed to develop SME customers in the areas of manufacturing, production, and agriculture. Under this scheme, SDB bank disbursed LKR 340mn for SME and tea development sector. | A special women's program was conducted in all 94 branches of SDB bank with a total participation of 1500 women. In this program, a female entrepreneur who had succeeded through SDB bank assistance shared her experience with fellow female participants. As a result, 1500 new women customers were onboarded. | A new saving product called ‘Business Saver Account’ was introduced with a digital banking facility. This enables the customer to earn an additional income from their daily business turnover whilst enjoying the online transactional facilities. Besides, the product is also intended to take digital banking as a practice to the micro and small entrepreneurs in addition to the medium scale entrepreneurs. This new product succeeded in onboarding 7800 new customers during the year. |

What We Offer

| General Saving | Fixed Deposits | Investments | Loans | Leasing | Pawning |

| General savings with attractive interest rates. | A highly secure, risk-free financial investment with a guaranteed lump sum of money at the end of maturity periods. | A range of investment targets and tenures to choose an ideal financial solution. | Loan schemes with attractive interest rates and repayment options to suit the diverse needs of the customer. | Personalized leasing packages to suit individual requirements with flexible repayment schemes at competitive rates | Fast and secure monetary assistance through pawning gold jewellery for critical financial need |

Specialised Products

Senior citizens: In appreciation of their dedicated service over the years, we have introduced a range of financial products to support their welfare. Under the title ‘Upahara’, we offer saving, fixed deposit, and loan schemes to empower Sri Lanka’s senior citizens to be fulfilled in their post-retirement life while also contributing to the country’s economy.

Women: In our commitment to empowering female entrepreneurs in Sri Lanka, we offer several products under the title ‘Uththamavi’ supporting their financial security and well-being. These include a saving scheme, an investment package as well as a loan product to cater to their diverse requirements. Besides, we have also introduced a short-term loan scheme, ‘Athamaru’ that allows women customers to do low-risk credit transactions using gold as collateral.

Youth: We understand the significant role played by youth in acountry’s economic development and therefore support their dreams through financial assistance. Introduced under the title ‘Jawaya', these products include savings and loan schemes that support them to develop and maintain strong financial strategies.

Children: In our commitment to build a strong financial foundation for the children and encourage their habit of saving we have introduced two saving products - ‘Lakdaru’ and ‘Dayada'. We believe such a financial foundation will enhance their capacity for prudent financial management in the future thereby contributing effectively to the country's overall development.

Veterans: We pay tribute to our armed forces through the 'Uththamachara’ loan facility which is available to war veterans who are suffering from disabilities, and families of deceased military personnel to support their income-generating activities.

Co-operatives

The SANASA Co-operative network contributes nearly 30% to the SDB’s total deposit base. This network known as the “SANASA Movement” is the largest cooperative network in the country and consists of over 8000 cooperatives with over 3 million members. SANASA cooperatives are member-owned societies and are grouped under the SANASA Federation and are overseen by the Department of Co-operative Development. These cooperatives are particularly active in rural areas and SDB was created to serve as their main financial institution.

The key objective of this cooperative model is to encourage rural development through the provision of credit to grassroots-level communities. Our core focus remains entrepreneur development with an enhanced emphasis on agriculture-related enterprises. Therefore, SDB bank continues to nurture healthy relations with these societies by participating in their meetings and discussions as well as conducting workshops and trainings on financial management and literacy where necessary. Our support further extends to providing these societies with concessionary facilities assisting them in business development including the creation of new value chains. During the year we introduced the 'Co-op Saver' product offering high-interest rates to the cooperative sector. We have also introduced digital products to societies to drive digital inclusion and enhance convenience. During the year under review, LKR 2.5 Bn worth of transactions was carried out through this platform.

Going forward, we intend to utilise relationship development strategy in building a loyal cooperative customer base. To this end, we will conduct relationship build up programs with cooperative departments across the SANASA corporative network with the aim of introducing bank’s services to the corporative societies and its members. Further, the Bank will continue to assist the co-operative societies to increase their business volumes through conducting Outbound Training programs with these societies including staff training programs and business-related training programs. We also intend to introduce a payment card for the cooperatives for which we are currently awaiting approval from the CBSL. Additionally, promoting value chains in production cooperatives, linking markets with societies, as well as developing weak societies remain priorities on our agenda.

Business Banking

This segment which was commenced in 2020 caters to the larger corporates where we provide a variety of products for businesses of all sizes in various industry sectors supporting their continued growth. Three types of products are covered under this segment which includes asset products, liability products and value-added services. While maintaining service excellence and digital and internet banking facilities to provide customers with a greater experience, we continue to extend our support to businesses that are involved in agriculture exports in addition to assisting sustainable development projects and energy projects.

As a development bank that is focused on national development, within this segment we have identified priorities for industry sectors that require support during this challenging economic backdrop. As such, we have extended our support to manufacturing, agriculture production, renewable energy, IT and export industries that are impacted due to high inflation. We assisted them through a shortterm loan facility and working capital loan facilities to ensure their continued operations and contribution to the local economy. We are committed to supporting the export industry in addition to initiating value chain finance and dealer chain finance.

Suppliers

The suppliers play an essential role in our business functioning as they provide the necessary support services required for the efficient functioning of the Bank. The bank procures a range of services from over 400 suppliers who contribute to our productive operations in various ways. We ensure that all the suppliers comply with the required industry standards including the stipulated standards of the Bank. As a development bank that is focused on empowering the local communities through supporting progressive masses, we strive to obtain products and services necessary for our functioning mostly through local suppliers including the associates of the SANASA federation.

Our suppliers include;

- Utility service providers

- Transport service providers

- Software vendors and support services

- Material suppliers

- Maintenance services

- Waste management services

- Debt collection agencies

- Landlords

- Contractors

Business Partnerships

We have fostered various strategic business partnerships with local and global entities that support our continued progress and long-term value creation. These associations have increased our competitive edge while reinforcing our ability to assist the progressive masses at the grassroots level.

Local Partnerships

Institute of Chartered Accountants of Sri Lanka

SDB bank partnered with the Institute of Chartered Accountants

to educate the local SMEs in financial management and literacy.

Carried out in the form of mentorship programs, this endeavour

involved over 1000 volunteer Chartered Accountants as

mentors and financial educators for the SMEs. This partnership

will support the expansion of our customer base in addition

to creating opportunities for grassroots-level entrepreneurs to

advance in their businesses contributing to the overall economy.

MILCO (Pvt) Ltd

SDB bank partnered with MILCO (Pvt) Ltd to support the country’s

dairy industry and provide financial assistance to dairy farmers

from the MILCO farming network in the North Central Province.

This initiative was a timely intervention given the high demand for

local dairy products and the industry's growth prospects.

Sri Lanka Banks’ Association’s Sustainable Banking Initiative

(SLBA SBI)

The Bank remains active within the Sri Lanka Banks’ Association’s

Sustainable Banking Initiative (SLBA SBI) with Mr Adheesha

Perera, Senior Manager - Strategy and Head of Sustainability

representing SDB bank as a Core Group Member of the initiative.

Global Partnerships

SDB bank is currently engaged with the international cooperation section of the EU in Sri Lanka, through which preliminary discussions are underway with a DFI, which has an EU blended finance window, for a long-term funding facility for sustainable agriculture for smallholder farmers.

The Bank has also established associations with the International Cooperative Alliance, Asian Confederation of Credit Unions (ACCU), International Raiffeisen Union (IRU) and Centre for International Cooperation in Agriculture Banking (CICAB) in harnessing opportunities in the global cooperative arena.

SAPP, IFAD, and MILCO

SDB bank partnered with Smallholder Agribusiness Partnerships

Programme, IFAD (International Fund For Agricultural

Development), and MILCO with the aim of uplifting small-scale

dairy entrepreneurs and boosting national milk production.

DIMO

SDB bank renewed its MOU with DIMO to uplift the Sri Lankan

agriculture sector by offering financial solutions and equipment

financing for agricultural mechanisation.

We further maintain memberships with the following association in expanding our network, knowledge and expertise.

Membership of Associations

- Leasing Association of Sri Lanka

- Association of Professional Bankers’ of Sri Lanka

- The Ceylon Chamber of Commerce

- Employers’ Federation of Ceylon

- The Association of Banking Sector Risk Professionals in Sri Lanka

- Association of Compliance Officers of Banks in Sri Lanka

- Sri Lanka Banks’ Association (Guarantee) Limited

- The Financial Ombudsman Sri Lanka (Guarantee) Limited

COMMUNITIES

Our commitment to uplifting the grassroots level communities does not end with the financial inclusion of smallholder and women entrepreneurs but also extends to the larger community in which we operate by addressing their pressing concerns. Leveraging on our strong community presence across the nation, we continue to address critical issues of those communities thereby reflecting our accountability and commitment to the betterment of society at large.

Corporate Social Responsibility (CSR) at SDB bank

SDB bank’s ESG framework provides direction to the CSR initiatives that are implemented in alignment with the Banks' overall CSR vision and strategy. Currently, our key focus areas in relation to CSR include financial assistance to SMEs and women entrepreneurs, capacity building as well as improving the living standards of disadvantaged communities.

CSR Activities

As part of our 25th-anniversary celebrations, we commenced a reforestation project with the objective of embracing sustainable finance. As such, we focused on climate adaptation through an ecosystem restoration project utilising an agroforestry model. From an environmental perspective this project endeavours to restore the ecosystem while from a social perspective, it attempts to create economic value for the local community.

Consequently, in partnership with the Dumbara SANASA Cooperative Union, we continue to support the income generation of the local community by supporting them for cash crop cultivation and the promotion of the agroforestry model amongst the Cooperative unions and the ground-level farmer societies. In doing so, we have provided technical assistance to the Cooperative societies and farmer societies.

Besides, under the CBSL’s ‘Green Village’ concept, we are supporting the nearby schools in the same area to establish an IT lab in addition to the donation of books for their library. In the near term, we intend to introduce livestock farming to the community through a loan scheme.

In addition, during the financial year we conducted awareness sessions for the farmer communities relating to good agricultural practices as well as on medicinal plants of Sri Lanka.

REGULATORS

We sustain our relations with regulators through consistent adherence to all the industry standards including CBSL guidelines and SEC regulations in carrying out our business operations.