Operating Environment and Strategy

Our Strategy

SDB Bank was established as the main financial institution of the Co-operative sector in the country and a significant contributor to national development. Today SDB Bank has evolved into a key financial institution serving the progressive masses with a keen interest in M/SME, Retail and Business Banking sectors in addition to its Co-operative roots. It is a value based banking partner championing financial inclusivity, empowering entrepreneurs and environmental & social resilience. The Bank pursues these objectives by providing its customer base with high-quality, innovative and competitive financial products and services leveraging the Island wide branch network that is spread across 94 locations. Our well-trained customer service agents closely engage with the customers in understanding their specific requirements and support them to realise their financial requirements. Backed by cutting-edge technologies and a team of diverse talents, we consistently strive to provide a total solution to our valued customers endeavouring to be the most responsible financial institution in the country.

Strategic Direction in 2022

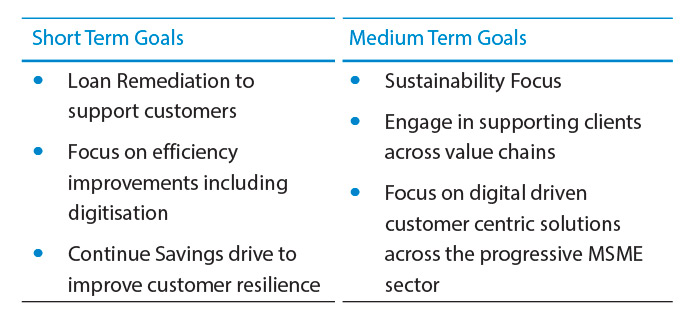

Despite the challenges in the operating landscape, we were steadfast in driving our growth plan for the 3-4 years further extending the transformation program that was initiated in 2019. The Bank's strategy primarily focused on our core objective of wealth creation for the grassroots level communities positioning the Bank as the "Bank for the progressive masses" and aiming to drive the upliftment of cooperatives, regional enterprises, and livelihoods.

Driving financial inclusivity has been one of the key objectives of the Bank. Hence, with a greater emphasis on the M/SME segment, an important driver of local economy, we continue to provide financial assistance to SMEs having set up a dedicated SME Development Unit within the bank to strengthen our presence within the sector. This has enabled us to serve SMEs of varied sizes and scales including micro businesses and co-operatives supporting them in their growth and evolution. Our financial assistance is mainly focused on SMEs engaged in export- oriented value chains setting the foundation for an export-driven economy.

Empowering women entrepreneurs is another strategic priority where we moved a step further in supporting numerous individuals and enterprises especially women entrepreneurs providing them with the necessary capacity building and technical know-how for them to move ahead as strong businesses that are built on best business practices. Another vital aspect of our strategy is the focus on Business Banking and value chain financing which will connect these enterprises to potential buyers.

In steering greater penetration into the rural economy and communities, we have also invested heavily in the digitisation of processes and service delivery as part of our transformation journey positioning the Bank as a future-ready digitally powered bank.

Digitisation is a key facilitator in improving reach taking banking to the larger populace attaining both financial and digital inclusivity.

ESG Focus

As a bank that is focused on sustainable value creation over the longterm, the bank has recognized both the need for ESG risk management and the imperative to mobilize sustainable finance. Therefore, we have incorporated Environmental, Social and Governance concerns in our growth strategy in taking the ESG mandate forward and have scaled up our initiatives for the same with a focus on environmental preservation and social welfare. When considering partnerships or financing, we give preference to businesses and initiatives that take a sustainable approach over those that do not.

Risks and Opportunities in Delivering Strategy

The macroeconomic headwinds impacted the customers' repayment capacity leading to potential repayment pressures. Multiple moratoriums coming to an end and the high-interest rate environment continue to be a massive challenge for customers and banks. However, despite these risks, the prudent measures adopted by the bank to ensure customer resilience has enabled the bank to maintain a strong capital base and enhanced liquidity stock.

Risks and Opportunities in Delivering Strategy