Management Discussion and Analysis

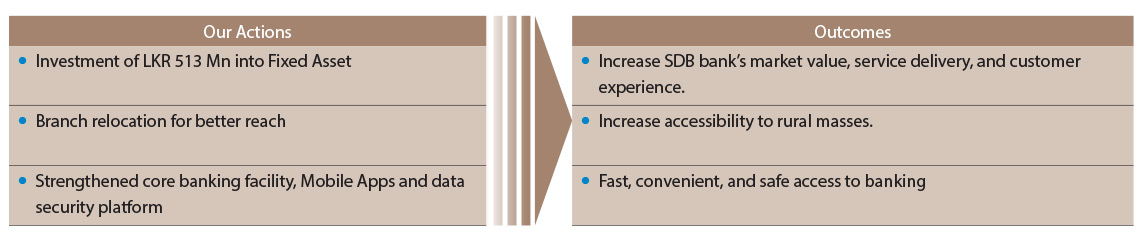

Manufactured Capital

Physical Assets

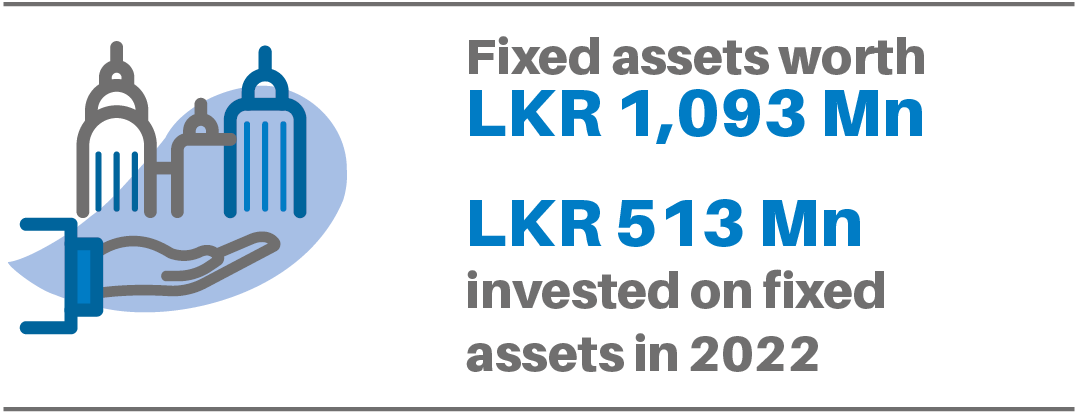

Our physical infrastructure includes land and buildings, leasehold properties, computer hardware, machinery and equipment, office furniture and fixtures as well as Company vehicles. The value of these tangible fixed assets is worth LKR 1,093 Mn. During the financial year under review, we invested an amount of LKR 513 Mn.

During the year, despite a challenging external environment, we were steadfast in seeking the right skills and traits that could drive our strategy in the long term. We also continued to improve the existing talents of employees by providing them opportunities to enhance their capacities to perform their current job roles more effectively while strengthening their future career paths.

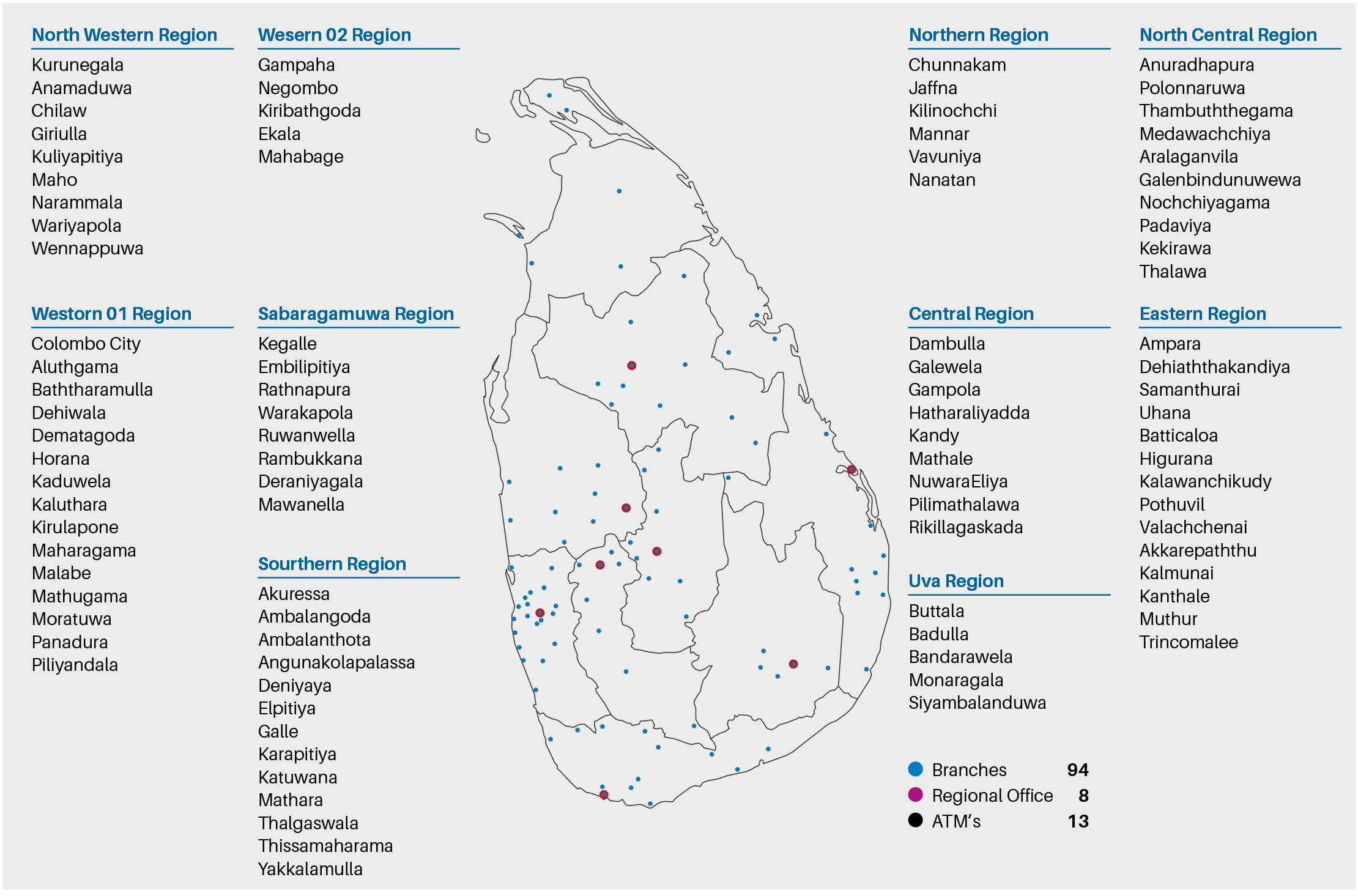

Branch Operations

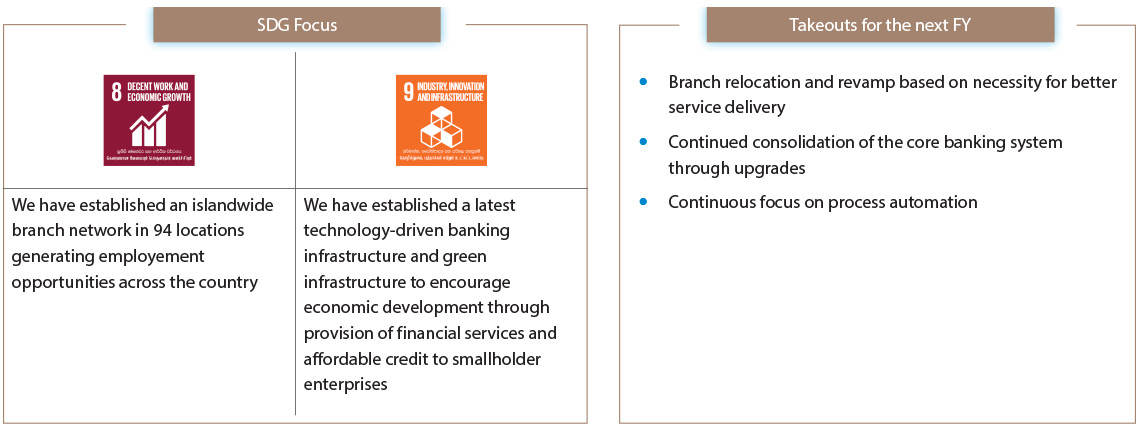

SDB bank operates a network of 94 branches island-wide which is fully equipped to provide a wide range of financial services to its diverse clientele that comprises Retail, SME, Co-operative and Business banking clients. Utilising its own as well as leased buildings that form the branch network that has inclusive coverage, SDB bank continues to deliver enhanced value to the customers creating noticeable change at the rural and grassroots level, subsequently impacting the overall economic progress of the Country. Our Head office is located at 12 Edmonton Rd, Colombo 06.

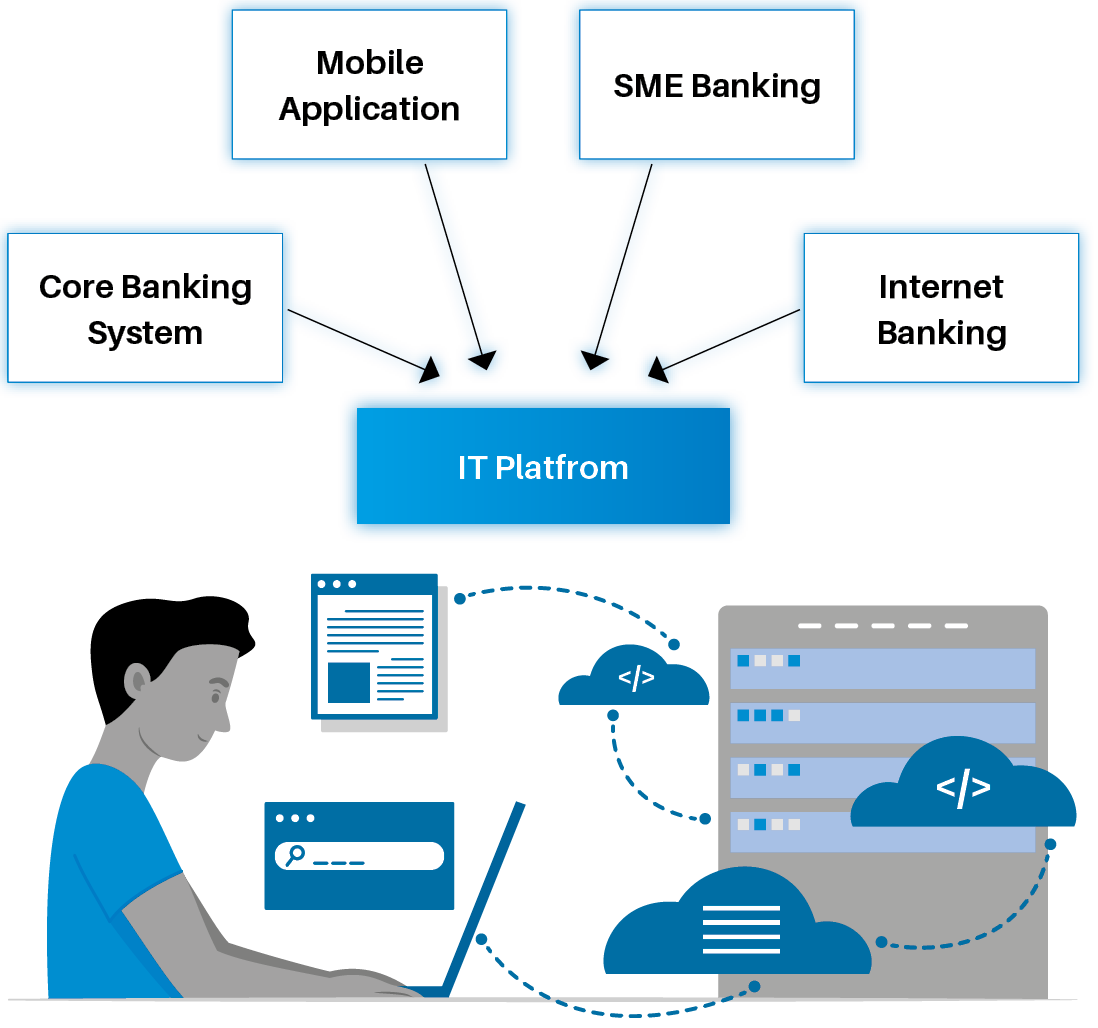

IT Platform

Our main technology platform is the SDB bank’s core banking system that processes our daily banking transactions with realtime banking facilities. From customer onboarding to customer relationship management, deposit and withdrawal processing, and loan issuing, our core banking system supports a multitude of banking transactions at the convenience of the customer. During the year, we have taken initiative to further consolidate the system with full compliance to CBSL standards and upgraded it with iserver version 15 in improving the customer experience. This platform mainly caters to our corporate clientele including companies, trusts, partnerships, proprietorships, and others.

SDB bank’s mobile app/UPAY app offers the customer a fast and convenient space for banking transactions on a user-friendly interface. This personalised mobile app enables customers to perform basic day-to-day banking requirements at their ease, quickly and in a secure manner. The main services provided by this app include online transactions with balance inquiries and internal and external fund transfers catering to the increasing demand for mobile banking amongst Sri Lanka’s digitally inclined customer base.

We also offer an SME banking facility for those customers who wish to perform instant balance inquiries, mini account statements, and receive transaction alerts at their convenience.

Similarly, we have a corporate internet banking facility that enables businesses for simpler, faster and more secure transactions. Targeted for corporate clients with real-time access to company funds and transaction records, this allows companies to manage their financial on their own time.

All branches are also securely connected to the internet for effective service delivery.

Data Security

SDB bank has improved its data security aspect streamlining the local area network and implementing SD-WAM in partnership with Dialog and SLT. Information security policy was also upgraded to the final level streamlining our security information management (SIM) and implementing data loss prevention on the network.