Management Discussion and Analysis

Intellectual Capital

Knowledge and Skills of Employees

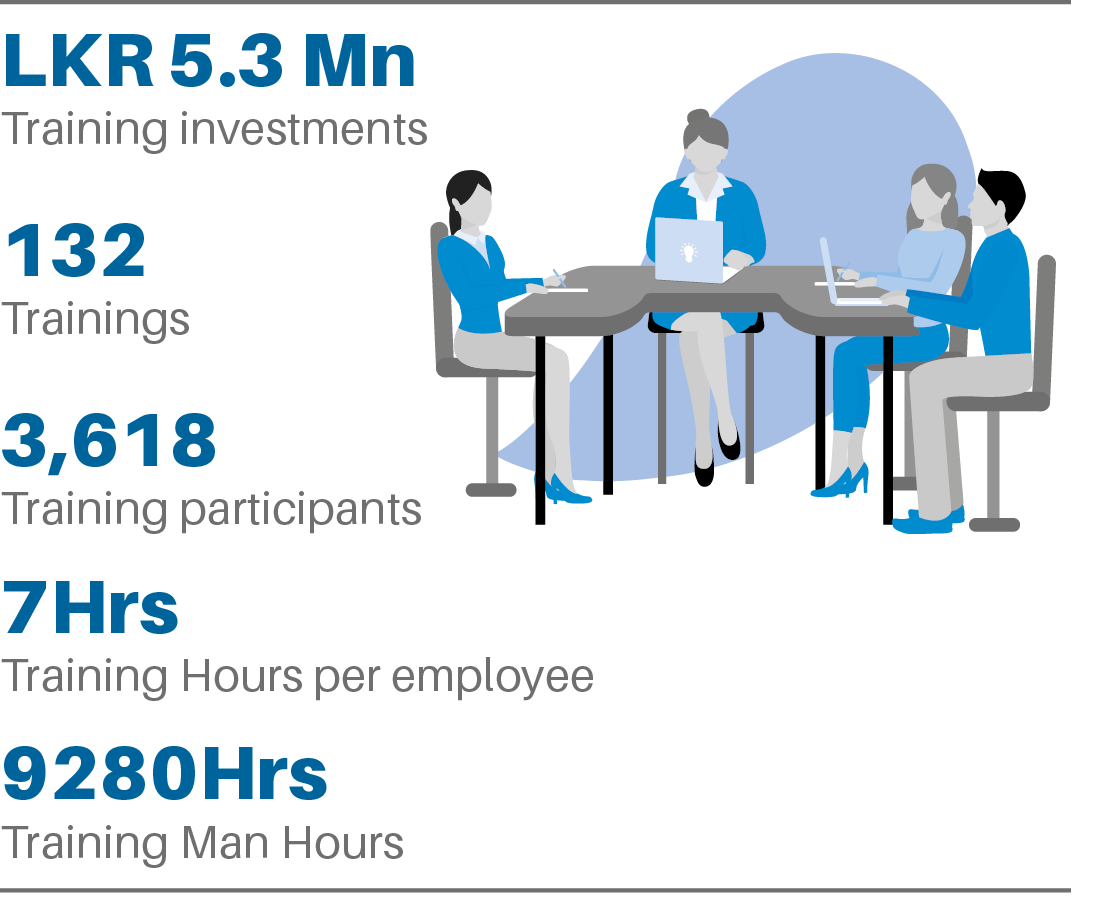

The knowledge and skill set of SDB bank employees is one of the key intangible assets of the Company that determine our growth progress. Therefore, we have invested in developing the appropriate knowledge, skills and behaviours of all our employees in meeting the Company’s business objectives in the short and long term. From top management to the executive level employees, our planned approach encourages employees access to learning and development opportunities that are primarily determined annually based on training needs analysis. During the financial year, 132 trainings were conducted mainly focusing on trainings related to leadership enhancement and technical skill development. Leadership trainings were aimed at identified potential individuals that are likely to become leaders in the future and focused on improving skills such as decision making, communication and problem solving. The technical skill trainings were intended to develop the employee’s technical competencies related to the banking sector.

Beyond this, we have nurtured a learning culture within the organisation where trained employees are encouraged to share their knowledge with their peers. As a result, we have a highly competent workforce who makes a positive impact on the productivity levels including a Board of Directors who has years on industry acumen and exceptional knowledge in their areas of expertise.

Brand Value

SDB bank continue to cater to changing customer needs through provision of financial support and value additions to life and businesses through mentorship and knowledge-sharing focusing on areas such as value chain enhancements and financial management. As an equitable financial service provider, we treat every customer equally supporting them in their development and financial wellbeing focusing on SMEs and women led businesses. In doing so, we strive to establish robust digital presence in realising the dream of digital inclusion of rural masses. Our brand resonates this commitment and being grounded on its founding principles, the Bank continue to empower all stakeholders having evolved over the years as a futuristic, value based, tech savvy and contemporary Bank that support the grassroot level enterprise development.

The Bank’s rise as a leading facilitator of national economic development, and a trusted authority on small-scale entrepreneurial and personal finance growth, has garnered it a strong reputation for continuous digital banking expansion, and as a preferred employer, all of which have contributed towards the Bank receiving numerous accolades recently. These include 47th spot amongst Sri Lanka’s Most Valuable Brands in 2022, as ranked by Brand Finance.

Marking 25 Years

As a key player in Sri Lanka’s SME-banking landscape, SDB bank has achieved the historic milestone of 25 years of service to Sri Lanka, supporting all Sri Lankans to grow and adapt to a changing world. The Bank’s 25th Anniversary celebrations commenced with an official press conference, which was held at The Kingsbury, Colombo on the 17th of August 2022.

To commemorate this historic milestone, the bank had planned a number of activities. Most notably, the bank inaugurated its 25th Anniversary Forest Restoration Project in Ududumbara, underscoring its commitment to environmental and social sustainability. This initiative, which took place on August 2022, saw the planting of a large number of new tree saplings on the day, and will be an ongoing project, with over 25 hectares planned and demarcated for reforestation, supported by SDB bank.

Future Facing

Moving beyond the milestone of 25 years, SDB bank is strongly positioned, financially, and in terms of expertise, experience and other resources, to sustainably fuel economic development in Sri Lanka, with a keen focus on the SME sector. In doing so, the bank has joined hands with prestigious global and local financiers and organisations that share its vision for an empowered and equitable society. In the present environment, the bank remains focused on creating new economic opportunities for all Sri Lankans and supporting export-oriented businesses, along with businesses that create value for Sri Lanka. Working together with like-minded partners, SDB bank is continue to further its goal and vision to develop Sri Lanka’s SME sector.

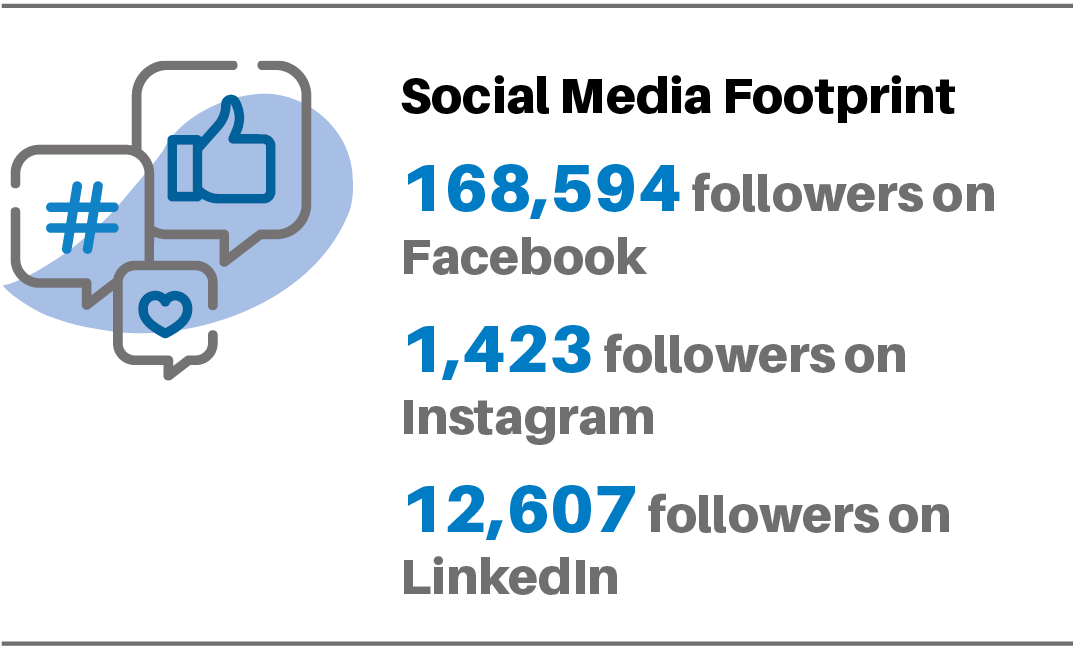

SDB bank also has a strong social media presence on Facebook, Instagram, LinkedIn and Youtube platforms where we proactively engage with customers by enhancing their product awareness and a series of educational content that would assist the consumers to traverse through challenging times. In addition, our official website also provides complete coverage of products and services enabling customers to access such information from anywhere at any time. In consequence, we succeeded in boosting our brand awareness among a wider audience, positioning our bank to foster the growth of small and medium-sized enterprises (SMEs), and thus, contributing to the economic prosperity of the country.

Our widespread branch network with 94 branches penetrates all areas of the island enabling access to masses across the nation. The well-trained staff of the bank continue to provide an enhanced experience to the potential and existing customers delivering a superior service to meet their requirements. During the year, SDB bank executed well-focused and highly effective product-centred marketing campaigns to promote our savings initiatives. In addition to enhancing our marketing activities on digital platforms, we engaged with our customers through on-ground activities to ensure effective communication. Several product campaigns were carried out to highlight our improved product portfolio tailored to meet the evolving needs of our customers. As part of our efforts, we launched two new products: "Business Saver Account" aimed at capturing the emerging business segment and "Top Saver +", a high-interest savings product targeting regular savers and salaried employees.

Corporate Culture and Ethics

SDB bank’s robust governance structure, policies and procedures that are in place ensure that our business activities are conducted in an ethical manner upholding the values of transparency and accountability in ensuring continued value creation. From the time of joining the organisation, the new recruits are given an induction to the Bank’s culture and values ensuring that they uphold these principles when carrying out business activities. We further demonstrate our integrity through an improved product portfolio that fulfils customer requirements, employee engagement in decision-making, cultivating a learning culture that encourages employees professional and personal growth, and space for expressing opinions and concerns.

IT Foundation

In our commitment to establish a technology driven banking platform, we continually improve our existing systems to increase efficiency and customer satisfaction. We upgraded our core banking system to iserver version 15 in full compliance with CBSL standards thereby providing an outstanding customer service. In addition, we have introduced a mobile app/UPAY app, where users can perform multiple digital transactions apart from accessing several value-added services. This multi-functional mobile wallet is directly connected to the SDB bank and other banks allowing various payment options including credit and debit cards transactions. These technological innovations have made financial services more accessible, low cost and easy to use.

We also provide the following services in our effort to fast-track towards digital inclusion.

- Paperless business model

- E signatures on loan applications

- Internet banking facility

Data Security

Information Security is of paramount importance to the SDB bank. SDB systems and technologies are deployed/ implemented and operated in line with industry standards and best practices. We strengthened the information and cyber security aspect of the Bank by implementing a set of processes and procedures for information and cyber security including state of the art technologies. Multilayered security architecture implemented along with the security and data protection solutions/ technologies that supports the Information Security Strategy of the bank have elevated the security posture of the bank. Such initiatives include data protection and leakage prevention, access management, security operations, endpoint protection, security event management, etc.

Further, the Bank has taken initiatives to increase efficiency and security in branch connectivity by implementing SD-WAN solution. This has provided not only the security of the connectivity but also increased customer experience due to the efficiency of the branch connectivity.

These implemented procedures have created a risk aware culture within the Bank while information security posture and related information are being independently evaluated by internal and external parties as well as by the Risk Management department of SDB bank from time to time.