Operating Environment and Strategy

Operating Environment

Global Economy

The global economy continues to demonstrate a sharp slowdown due to a multitude of challenges including high inflation, tightening financial conditions, geopolitical tensions driven by Ukraine Russia war, lingering effects of the COVID-19 pandemic as well as mounting concerns of a global recession and food insecurity.

According to the World Economic Outlook (WEO) of IMF released in October 2022, global growth is expected to drop from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is the lowest performance since 2001 with the exception of the global financial crisis and the period of intensified COVID-19 pandemic. This slowdown is mainly a reflection of the subdued performance of the largest economies such as the United States, Europe and China. The spillover effects impacted the performance of advanced economies as well as emerging and developing economies.

Inflation

Global inflation also remained considerably high impacting all stakeholders, particularly those who live in poorer countries affecting their socioeconomic well-being, living standards as well as the macroeconomic outlook in the near term. High inflation was mainly driven by demand pressures, delayed impact of policy interventions, disruptions to the supply chains and non availability of key commodities. Inflationary pressure is widespread among advanced economies with more inconsistency among emerging and developing economies and may continue to persist longer given the rise in energy costs and food prices. Global inflation is forecast to rise from 4.7 percent in 2021 to 8.8 percent in 2022 but to decline to 6.5 percent in 2023 and to 4.1 percent by 2024. This would lead to a tightening monetary policy to fight against inflation. Monetary policy will further support restoring price stability and lessen the cost-of-living pressures.

Outlook

The economic outlook will be influenced mainly by the monetary policy position in controlling inflation, the impact of the Ukraine- Russia war, supply chain disruptions as well as continued effects of the COVID-19 pandemic. Inflationary pressures may continue to build up owing to the increases in food and energy prices, supply chain pressures and tight labour market conditions. The war between Ukraine and Russia will contribute to an increase in gas and energy prices, supply chain disruptions as well as elevated

Local Economy

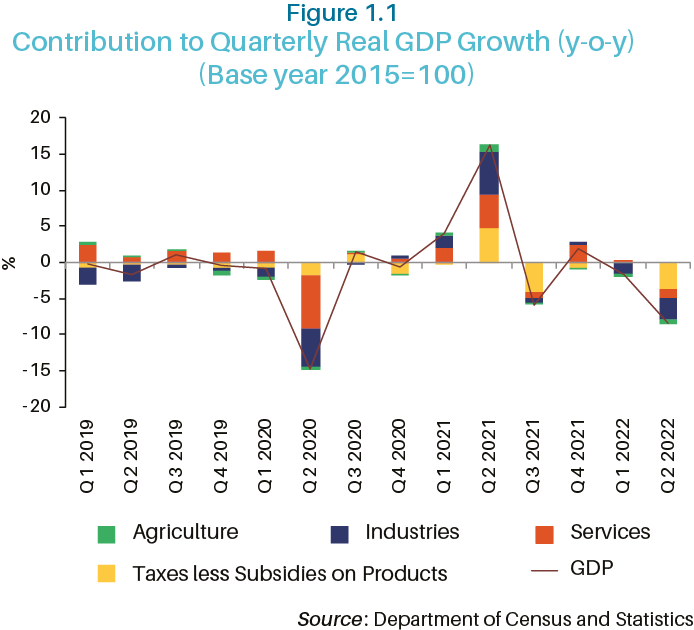

The first half of 2022 was faced with increased uncertainty as opposed to the second half of the year which demonstrated signs of stability mainly driven by the policy interventions towards a stable growth trajectory in the medium term. According to the Department of Consensus and Statistics, the Sri Lankan economy observed a year-on-year contraction of 4.8 percent during the first half of the year compared to the growth of 9.3% in the corresponding period of 2021. The year-on-year GDP growth rate for the year 2022 has been reported as a 7.8 percent of negative growth rate. The gradual recovery of economic activities since the COVID-19 pandemic, reversed since the beginning of 2022 due to intensifying economic crisis and shortage of foreign exchange liquidity that drove uncertainty in the economic front. Subsequently, all key sectors contracted amidst continued power outages, fuel shortages, scarcity of raw material, and increasing cost of production and price hikes in both the local and international markets dampening the economic stability in the country during the second half of the year.

The poorest households are severely hit due to food inflation, job loss, shortage in fertiliser and a drop in remittances. The relief measures were inadequate to face the loss in real income. The good trade deficit declined largely due to importune reflection while the current account deficit is expected to have widened due to the slow performance of the tourism sector and declining remittances. particularly impacted by the spillover effect of slow economic performance in China. The resurgence of the virus in some countries may also continue to threaten the economic recovery while slow human capital built up due to pandemic scarring may also hinder the progress of the global economy in the near term.

Labour Markets

The intensifying economic crisis also impacted the labour markets where the gradual recovery observed during the first half of 2022 was offset during the latter part of the year. Although the labour markets showed a revival from the pandemic phase with the ease of COVID-19 restrictions owing to improvements in Labour Force Participation Rates (LFPR), the growing economic uncertainty during the latter part led to declining of LFPR during the second half of the year. The LFPR increased to 51.2% in the first quarter of 2022 from 49.5% and 50.9% recorded in the fourth quarter of 2021 and the first quarter of 2021, respectively. However, slow economic activity led to a decline of LFPR to 50.1% during the second quarter of the year. The unemployment rate also declined to 4.3% in the first quarter of 2022, which was the lowest level in the last eight consecutive quarters, rising to 4.6% in the second quarter of 2022.

Inflation

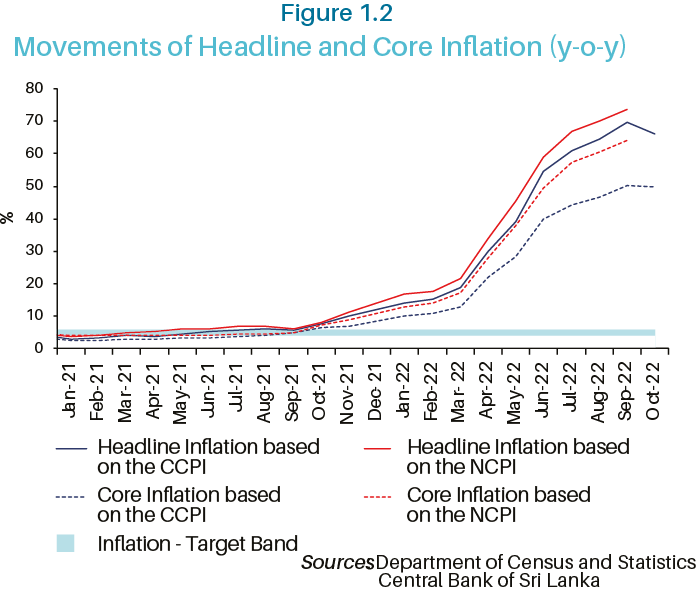

The country's inflation also rose to notably high levels since the beginning of the year which had a severe impact on the household purchasing power of the citizens. This was mainly driven by supply- side disruption on the local and global front, administrative price adjustments, rapid depreciation of the Sri Lankan Rupee, and repressed demand amidst the delayed impact of large monetary accommodation during the COVID-19 pandemic. Consequently, headline inflation accelerated towards the latter part of the year driven by food and non-food inflation. This reflected the impact of rising fuel, gas, and electricity prices in addition to the effects across the production chain. Accordingly, headline inflation, as measured by the CCPI (2013=100), accelerated to 69.8%, y-o-y, in September 2022, recording a substantial deviation from the desired range of inflation. However, the path of CCPI-based headline inflation has subsequently shown some signs of reversing by moderating to 66.0%, y-o-y, in October 2022. Meanwhile, headline inflation, as measured by the NCPI (2013=100), also accelerated to 73.7%, y-o-y, in September 2022.

Debt Default

Sri Lanka defaulted on its foreign debt during the year leading the worst economic crisis in the post-independence era. Outstanding central government debt increased to Rs. 24,945.9 bn by end September 2022 from Rs. 17,589.4 bn as at end 2021. By end September 2022, total outstanding domestic debt amounted to Rs. 13,345.6 bn while the rupee value of total outstanding foreign debt amounted to Rs. 11,600.3 bn. (Source: CBSL)

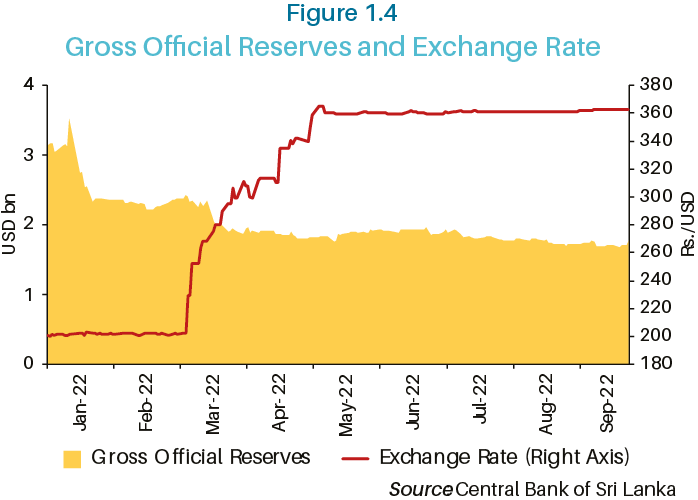

In line with these developments, the gross official reserves declined to USD 1.8 bn by the end of September 2022 in comparison to USD 3.1 bn recorded at the end of 2021. The shortage of liquidity also brought pressure on the exchange rate and the Sri Lanka rupee depreciated substantially by 41.4% against the USD by the end of April 2022. The overall depreciation of the Sri Lanka rupee against the USD stood at 44.8% during the year up to the end of October 2022.

External Sector

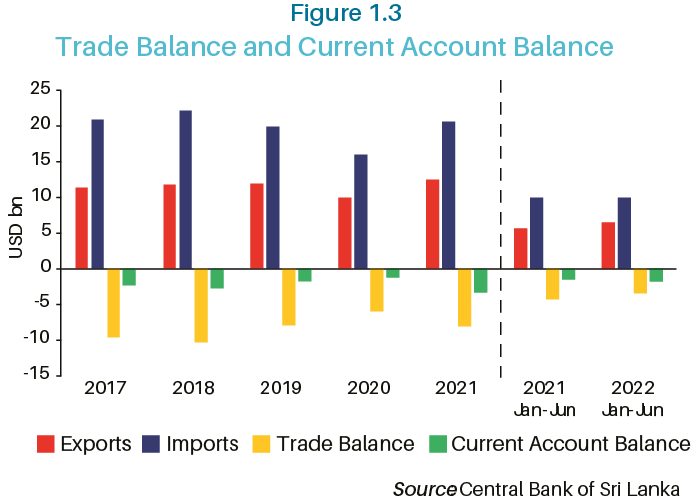

The volatile situation of the external sector during the financial year led to an acute balance of payment crisis with the increase in expenditure on merchandise imports during the first quarter of the year, policy measures were implemented to limit expenditure to improve the foreign exchange liquidity required for essential imports. Consequently, the import expenditure declined considerably since March 2022. Export earnings also continued to remain strong during the year. During the financial year, the merchandise trade deficit recorded the lowest since 2010. The tourism sector also showed a notable rebound while the workers' remittances remained modest during the year. Foreign investments in the government securities market and Colombo Stock Exchange (CSE) also recorded a notable net inflow during 2022 compared to a net outflow in 2021.

In line with these developments, the gross official reserves declined to USD 1.8 bn by the end of September 2022 in comparison to USD 3.1 bn recorded at the end of 2021. The shortage of liquidity also brought pressure on the exchange rate and the Sri Lanka rupee depreciated substantially by 41.4% against the USD by the end of April 2022. The overall depreciation of the Sri Lanka rupee against the USD stood at 44.8% during the year up to the end of October 2022.

Banking Sector Performance

The banking sector demonstrated resilience during the year 2022 despite the developments in the macroeconomic front maintaining adequate levels of capital and impairment coverage ratios. The capital position of the banks will continue to be impacted by the significant policy rate increase, economic contractions and effects of sovereign debt restructuring issues.

Assets of the sector also grew during the year compared to the corresponding period in 2021 due to the impact of the depreciation of the Rupee and the increase in investments. Total assets of the banking sector recorded a growth of 14.1% in the eight months ending in August 2022, compared to an expansion of 12.1% growth recorded in the corresponding period of 2021. Nevertheless, the asset quality of the banking sector weakened during the period under review as reflected by the increase in Stage 3 Loans to Total Loans Ratio. The profitability of the sector also dropped during the year owing to the increase in impairment charges.

Outlook

The year 2022 recorded a notable contraction of the economy due to a combined effect of a multitude of challenges that negatively impacted the overall economy. As such, the recovery in 2023 is expected to remain moderate due to the persistent economic volatilities, upward adjustment to domestic tax structures and the slowdown in the global economy due to monetary policy tightening by central banks to control inflationary pressure and effects on commodity prices emanating from geopolitical tensions. However, the envisaged macroeconomic adjustment programme is expected to drive growth from 2024 onwards creating a conducive environment for economic growth. In this regard, the implementation of structural reforms by the Government and other policymakers are considered essential. Such measures are expected to drive progress towards a sustainable growth path improving the resilience of the economy over the medium term.