Operating Environment and Strategy

SDB Bank's Commitment to Sustainability

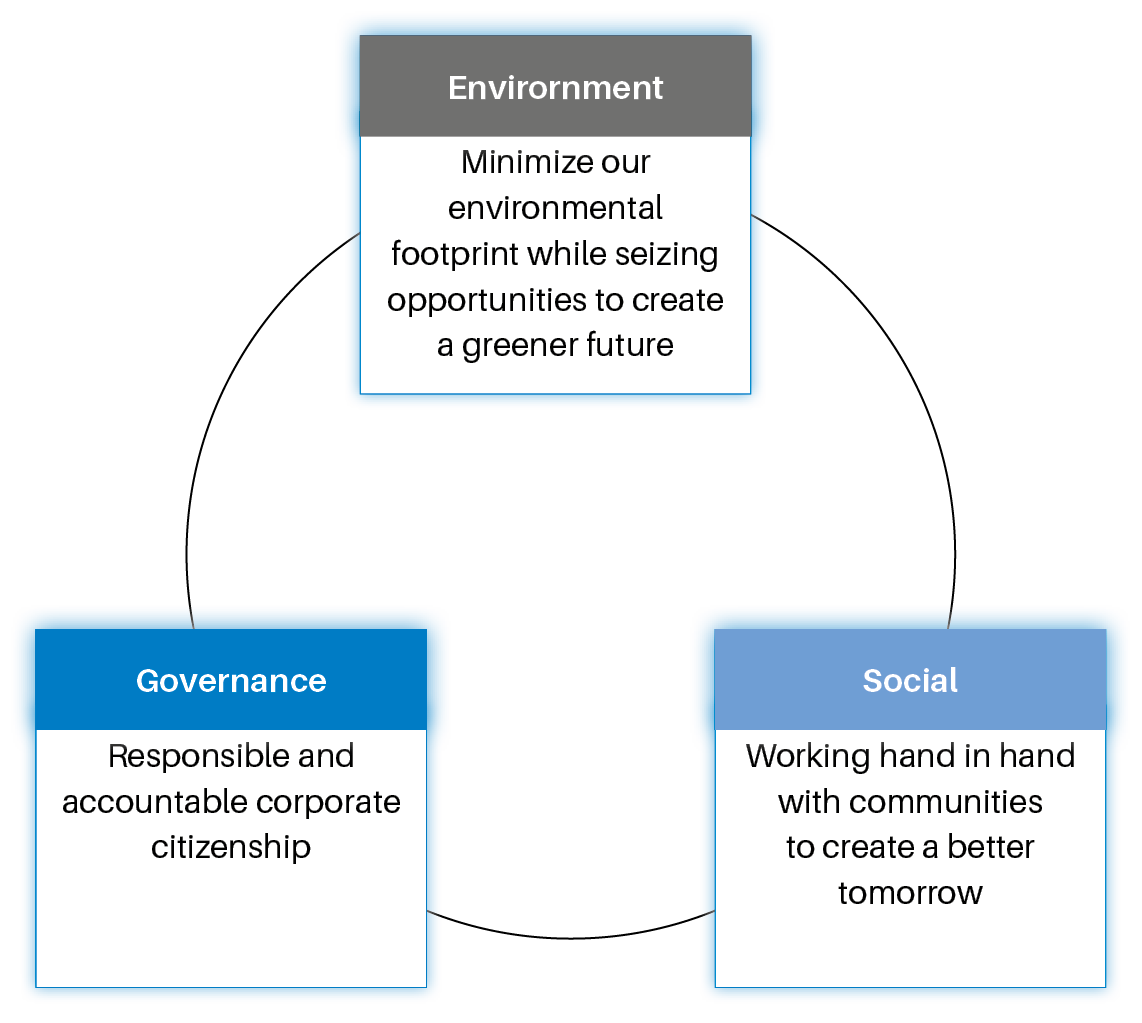

Our Approach to Sustainability

Amidst the challenging economic outlook in the aftermath of Sri Lanka's sovereign debt default, SDB bank remains committed to building a resilient and prosperous Sri Lanka that is underpinned by a sustainable recovery. Having set-up the governance framework on sustainability in the previous year and operationalized the safeguards mechanism (including on Environmental and Social Risk Management and on Universal Standards for Social and Environmental Performance Management), the mobilisation of the FY2022 focused on piloting initiatives that could help the bank to scale up its sustainable impact as the country achieves macroeconomic stability. From financing a commercial scale solar PV project for the first time in bank's history to researching on scalable model for nature- based solutions financing, the bank has been collaborating with external stakeholders to advance solutions that could contribute to a sustainable economic recovery in Sri Lanka.

The bank continued to integrate following sustainability management focuses during the year:

- Environmental and Social Risk Management System (ESMS)

- Social Performance Management (SPM)

- Sustainable and Inclusive Finance (SIF)

- Operational Footprint (OPF)

- Operational Resilience and Excellence (OPR)

- Sustainable Brand, Culture and CSR (SBCR)

- Integrated Strategy and Reporting (ISR)

One of the key developments in FY 2022 is the defining of focus areas for bank's sustainable finance strategy. Following key focus areas have been identified by the bank for mobilisation:

- Sustainable Agriculture

- Women Financing

- Circular Economy

- Digital Inclusion

- Green Tech and Infrastructure - Renewable Energy, Energy Efficiency, Green Buildings, Green Transport and Green Industry

- Promoting sustainable business practices among MSMEs and Cooperatives

In addition to identifying the high-level focus areas, the bank had also begun to set business segment level targets and KPIs related to above sustainable finance focus areas (both financial and non- financial targets). For example, on sustainable agriculture, the bank had set targets on awareness raising and capacity building of agri sector clients on the Sri Lanka Good Agricultural Practice (SLGAP) standard and had commenced a partnership with Agribusiness Development Division of the Department of Agriculture to drive the implementation.

ESG Considerations

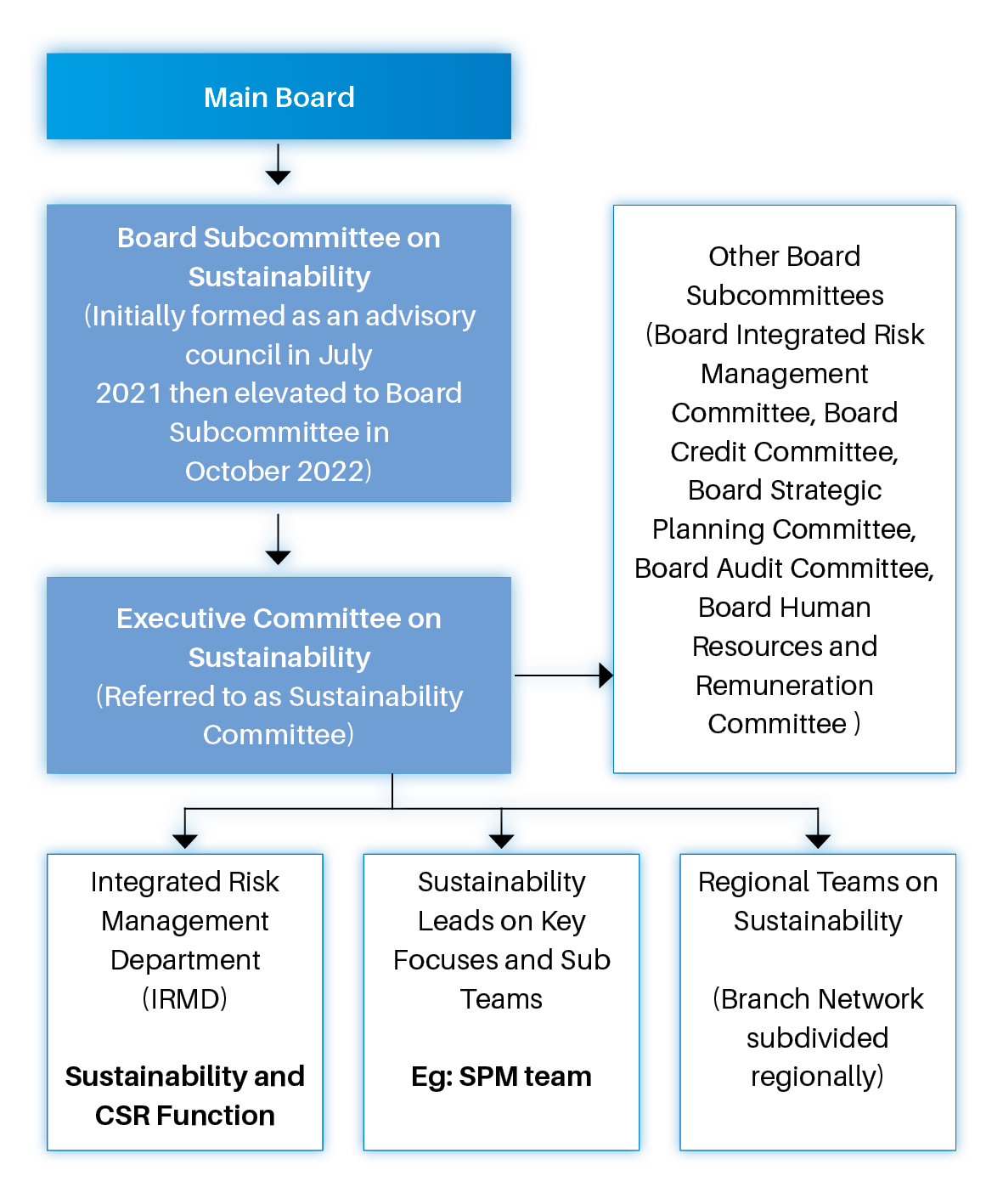

Sustainability Governance

Board Subcommittee on Sustainability

SDB bank is among the first three banks in Sri Lanka to set up a board-level committee on Sustainability. The Chairperson of the Board Subcommittee holds the responsibility to inform the Board of Directors every quarter of the Bank's sustainability performance. The committee comprises of selected representatives from the Board of Directors and Executive management with space to bring on board external sustainability experts.

This board subcommittee engages in the formulation of high- level policies and strategies relating to sustainability, guides the Executive Management Level Sustainability Committee and approves the sustainability action plan for the period under review. In FY 2022, the Board Subcommittee on Sustainability convened on 5 occasions and reviewed the status of bank's sustainability performance including strategy and progress on bank's ESG undertakings with its DFI investors.

Executive Committee on Sustainability

The Executive Committee on Sustainability under the guidance of the CEO is directly responsible for implementing the sustainability strategy of the bank. The committee is represented by the executive management and functional management including regional managers of the bank's branch network and the business line heads. The Committee provide direction for the implementation of the management systems and key sustainability goals of the bank (with the standard agenda of the meeting focused on the seven sustainability management focus areas mentioned above).

Regional Level Teams

In 2021, the bank had commenced the process of setting-up regional sustainability teams under the leadership of Regional Managers who drive the sustainability agenda at branch level. However, due to the challenging operating environment during the year, these regional teams could not be optimally operationalized.

The Bank is pursuing a partnership with UNDP BIOFIN program to obtain their support in building capacity among these regional sustainability teams on aspects such as green finance and internal footprint management.

Note: Sustainability initiatives carried out by the Bank is discussed under the Natural Capital section on page 80 of this report.

Capacity Building on Sustainability

In addition to providing access to the Sri Lanka Banks' Association's Sustainable Banking Initiative (SLBA SBI)'s e-Learning Platform for

the senior management, the bank also conducted specific awareness and training on social performance management. The Bank had initiated an Accompanied SPI4 Self-Assessment with the support of an external technical assistance (TA) provider who visited several branches and engaged with functional and senior management to understand the level of integration of Universal

Standards for Social and Environmental Performance Management. As part of this process, the external TA provider is also engaged in sensitising and capacity building of relevant staff.

The bank also conducted a Gender Gap Assessment with the support of the Asian Development Bank (ADB) where the consultants engaged with senior management and the functional staff to raise awareness on gender whilst conducting their assessment. While this external assessment recognized SDB bank's women entrepreneur financing strategy as being in the forefront in the industry, it also

called on the bank to conduct research and develop client centric solutions in the retail segment in addition to further focusing on recruiting and retaining female talent in bank's employee cadre.

Key representatives from the bank were also provided the exposure to trainings conducted by IFC, Central Bank of Sri Lanka and Colombo Stock Exchange on topics such as Green Finance Taxonomy; Green, Social and Sustainability Bonds; and TCFD.

Contribution to SDGs

Sustainable Development Goals provide an outline to achieve a sustainable future for people and the planet addressing the global challenges we have encountered at present including poverty, inequality and climate change, environmental deterioration, peace and justice. Hence, as a development bank that is steadfast in supporting the financial upliftment of rural communities, we endeavour to contribute to SDGs by evaluating our performance against the SDGs thereby attempting to make a difference in the lives of the grassroots communities.

| SDG | Our Contribution | |

|

No Poverty |

|

|

|

Zero Hunger |

|

|

|

Good Health and Wellbeing |

|

|

|

Quality Education |

|

|

|

Gender Equality |

|

|

|

Affordable and Clean Energy |

|

|

|

Decent Work and Economic Growth |

|

|

|

Industry Innovation and Infrastructure |

|

|

|

Reduced Inequalities |

|

|

|

Sustainable Cities and Communities |

|

|

|

Responsible Consumption and Production |

|

|

|

Climate Action |

|

|

|

Life on Land |

|

|

|

Partnerships for the Goals |

|